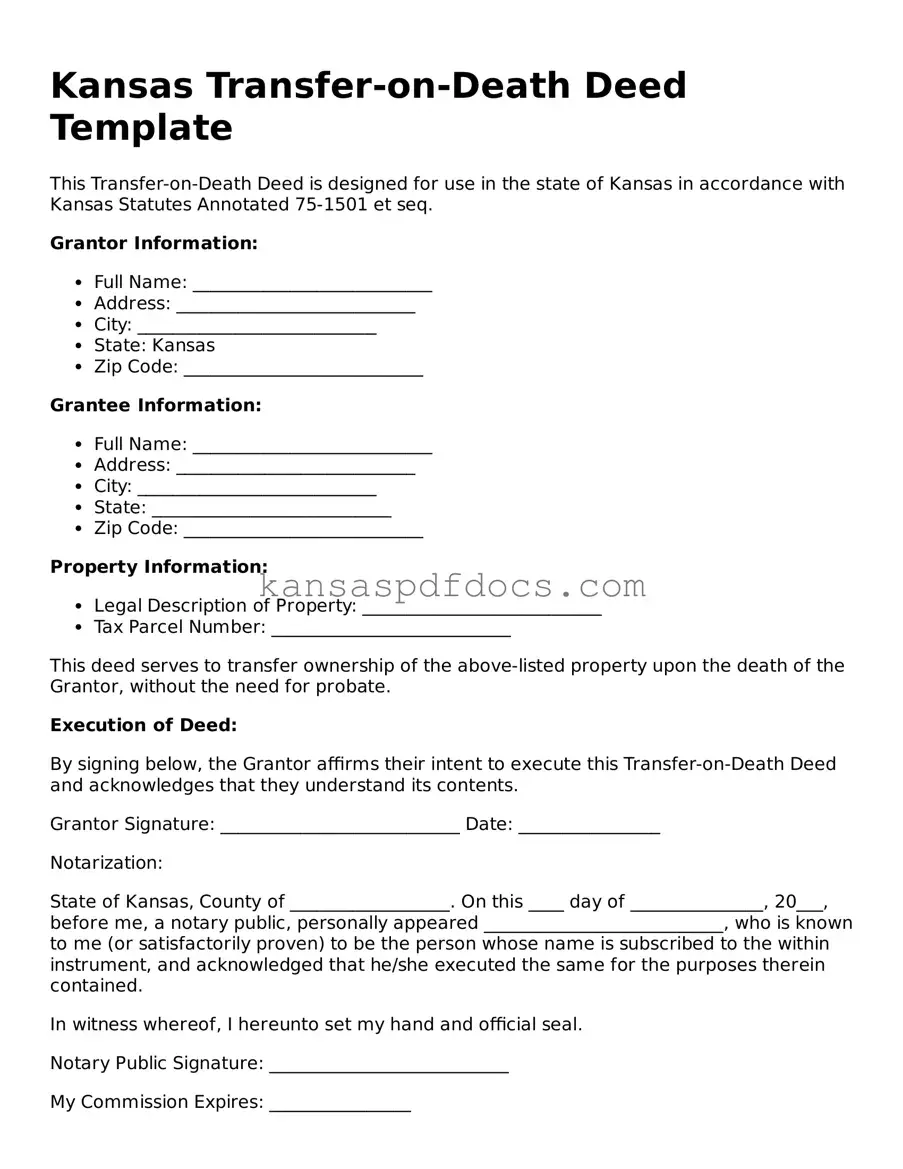

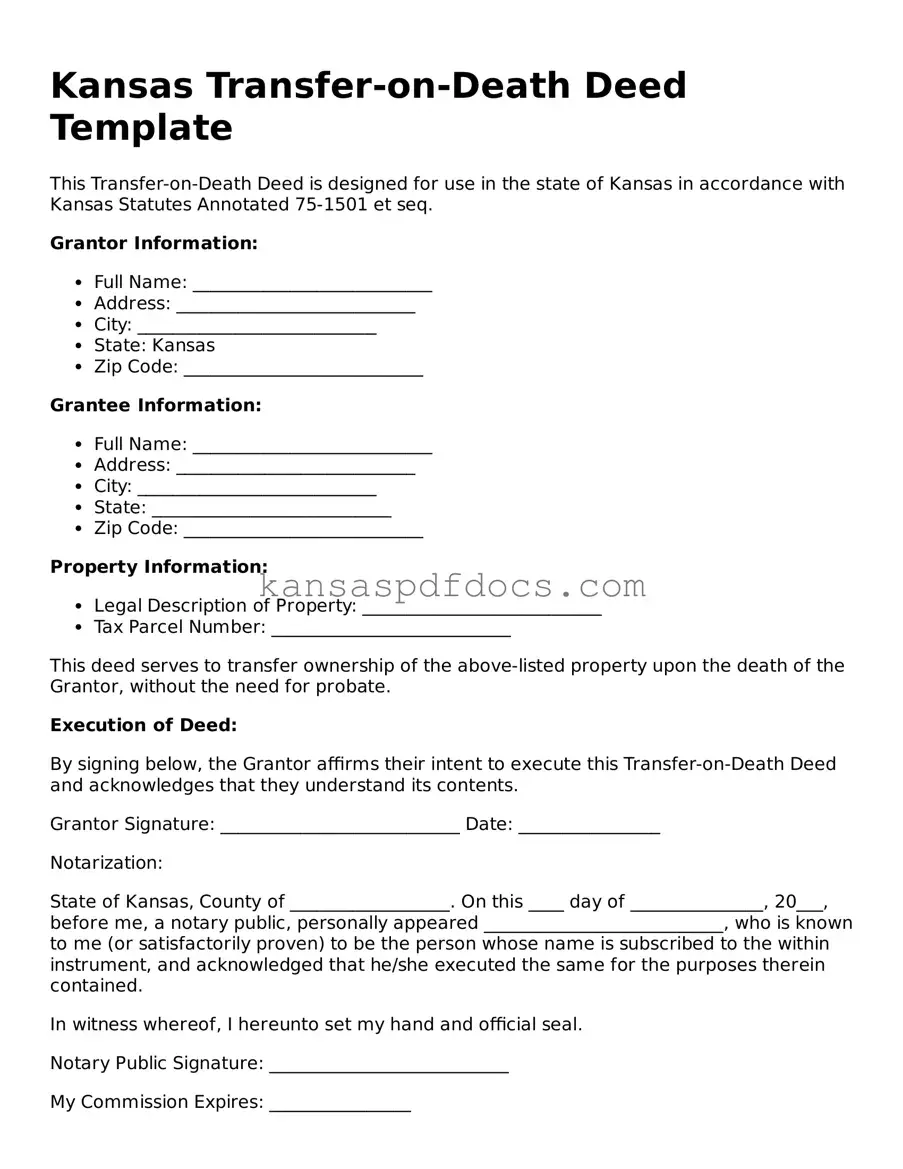

Valid Transfer-on-Death Deed Template for Kansas State

The Kansas Transfer-on-Death Deed form allows property owners to designate beneficiaries who will receive their real estate upon their death, without the need for probate. This legal document simplifies the transfer process, ensuring that the property passes directly to the named beneficiaries. Understanding the specifics of this form can help individuals plan their estate effectively.

Access This Form Now

Valid Transfer-on-Death Deed Template for Kansas State

Access This Form Now

Your form isn’t ready yet

Edit and finalize Transfer-on-Death Deed online without printing.

Access This Form Now

or

Get PDF Form