Download St 8 Kansas Form

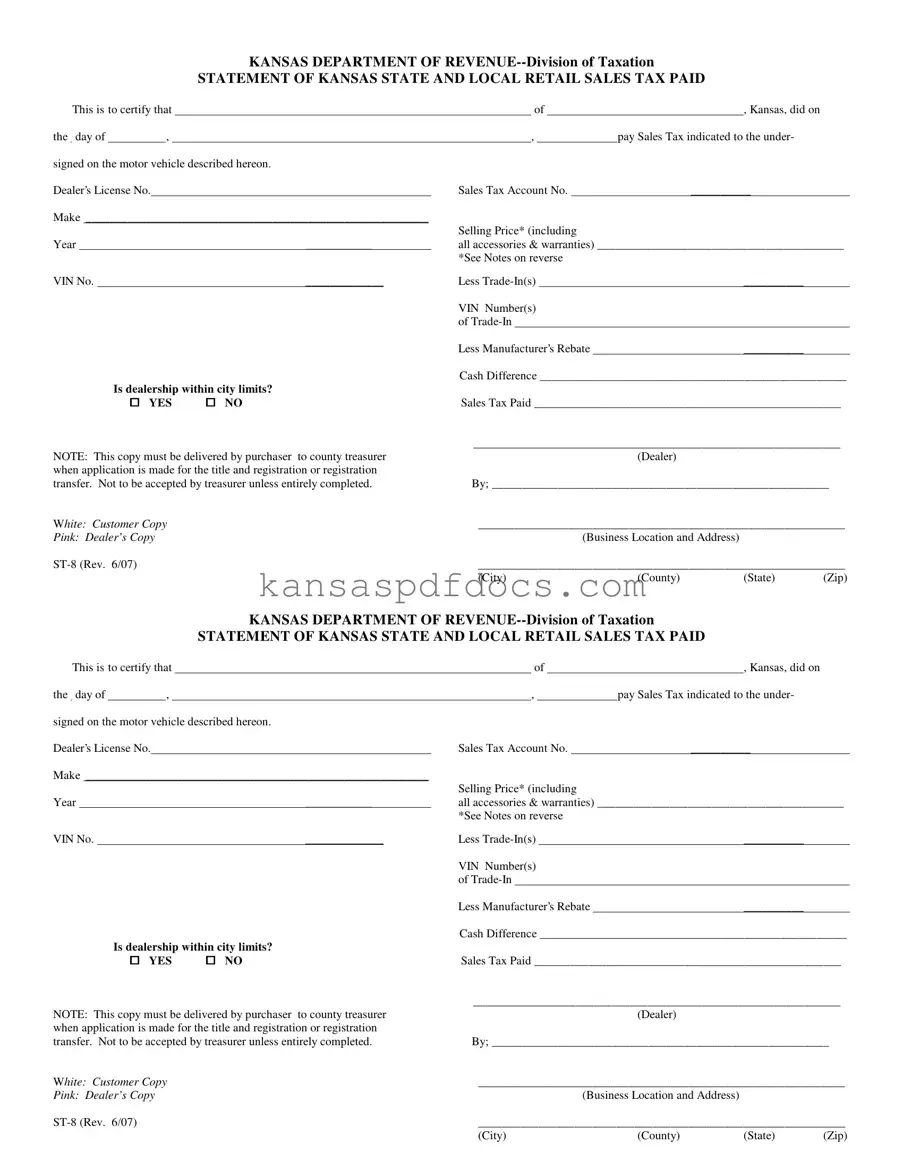

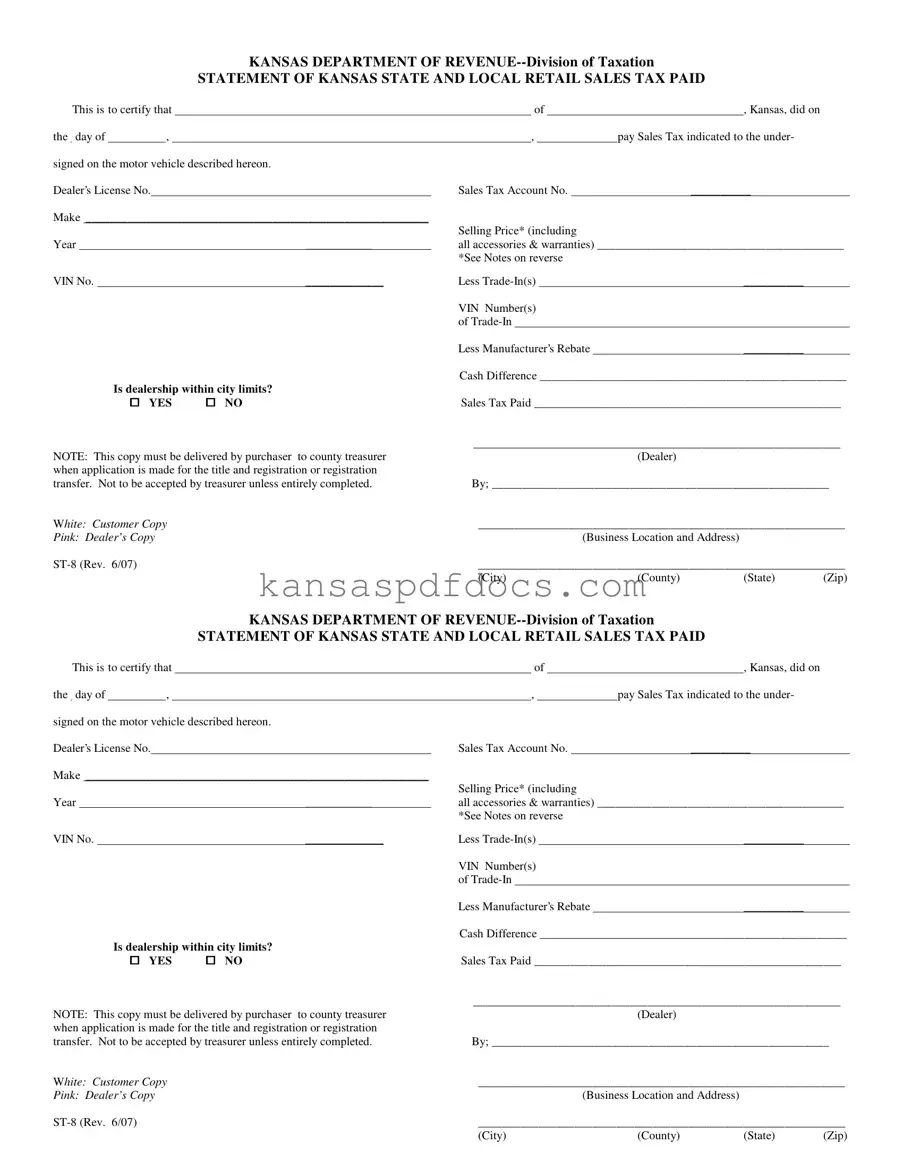

The St 8 Kansas form is a crucial document used to certify the payment of state and local retail sales tax on motor vehicles in Kansas. This form ensures that the necessary sales tax is accounted for during the vehicle registration process. Proper completion and submission of the St 8 form is essential for a smooth transaction and compliance with state regulations.

Access This Form Now

Download St 8 Kansas Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize St 8 Kansas online without printing.

Access This Form Now

or

Get PDF Form