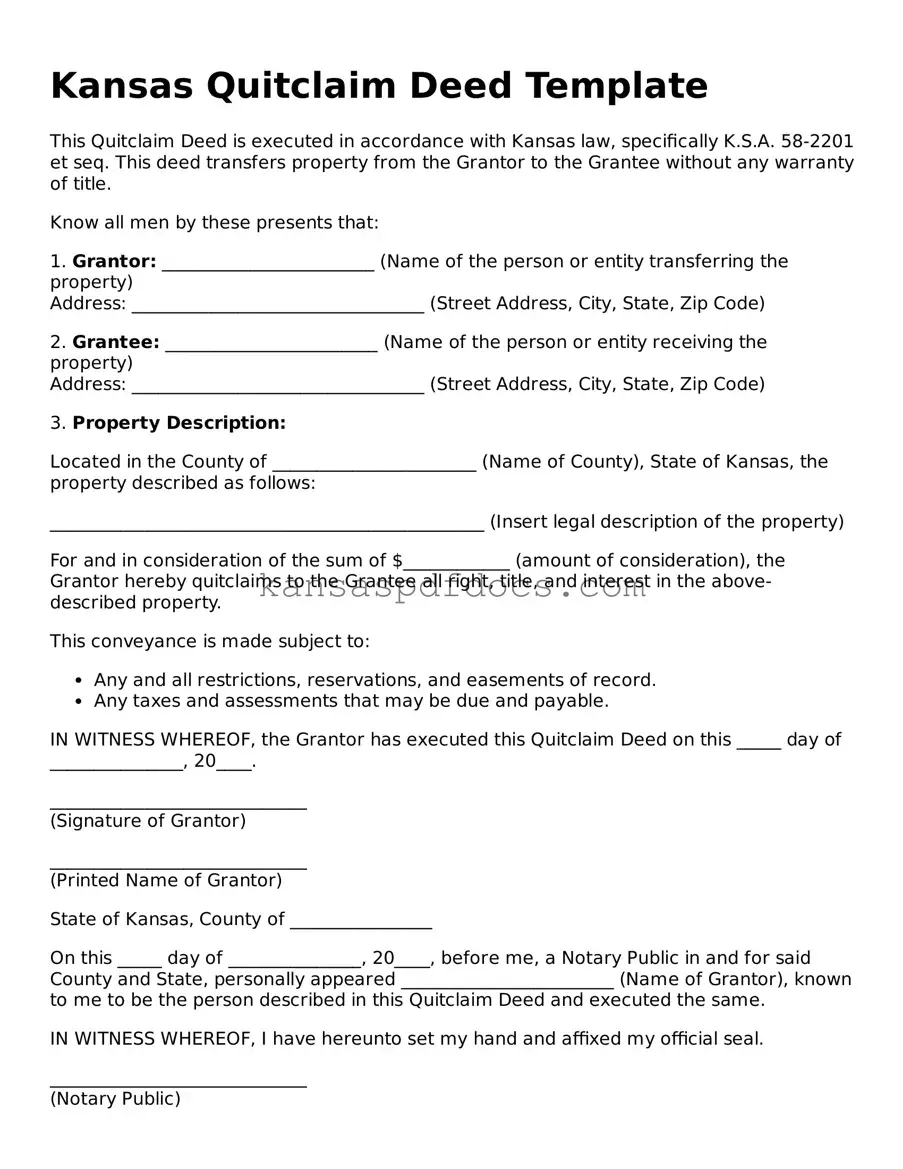

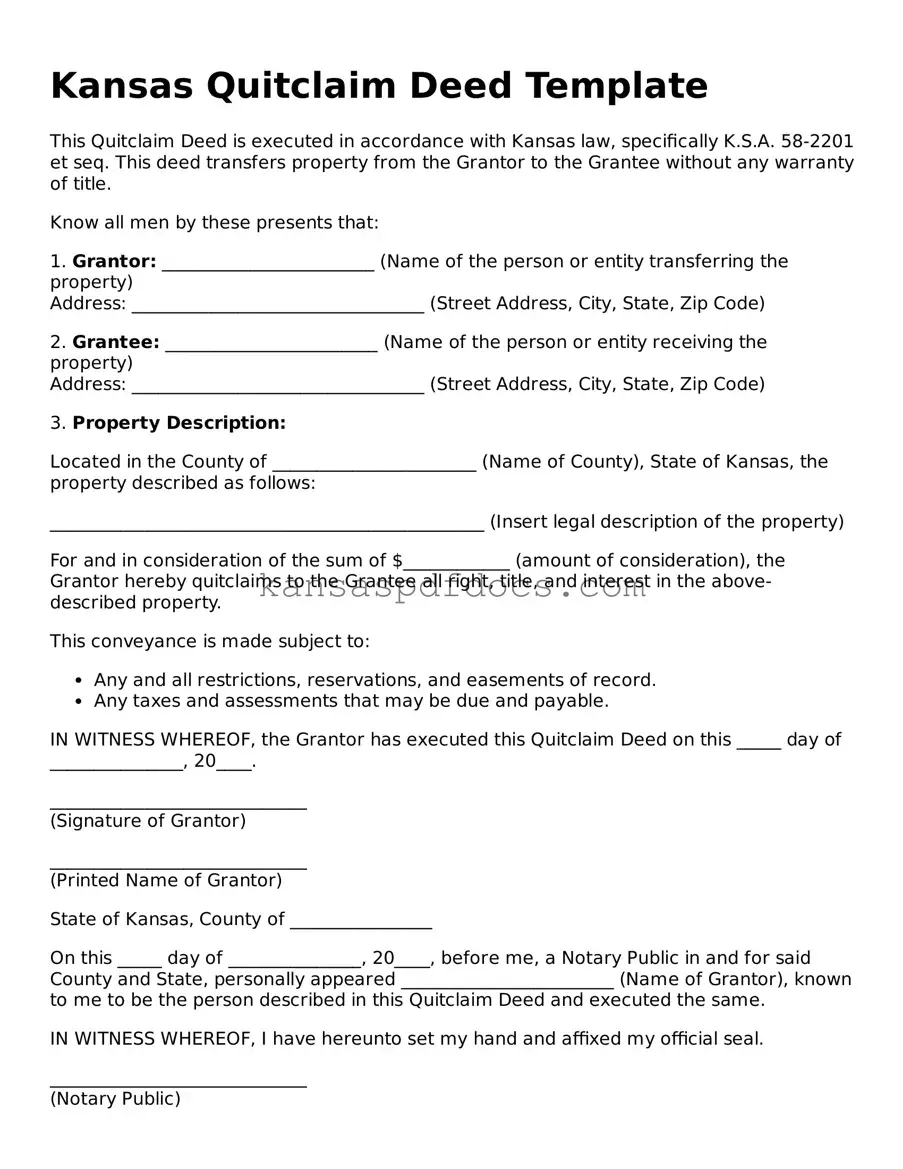

Valid Quitclaim Deed Template for Kansas State

A Kansas Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without guaranteeing the title's validity. This form is essential for individuals looking to convey property rights quickly and efficiently. Understanding its components and implications is crucial for both grantors and grantees involved in the transaction.

Access This Form Now

Valid Quitclaim Deed Template for Kansas State

Access This Form Now

Your form isn’t ready yet

Edit and finalize Quitclaim Deed online without printing.

Access This Form Now

or

Get PDF Form