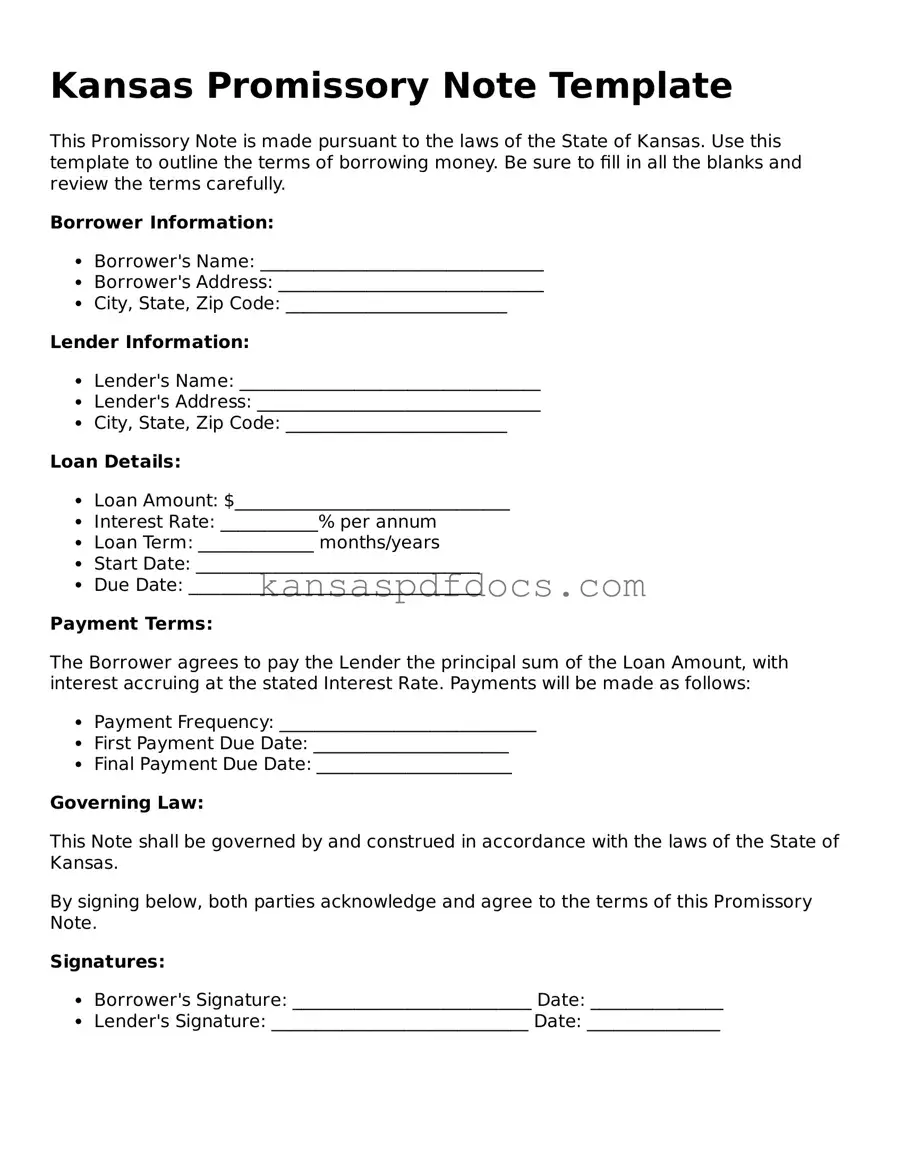

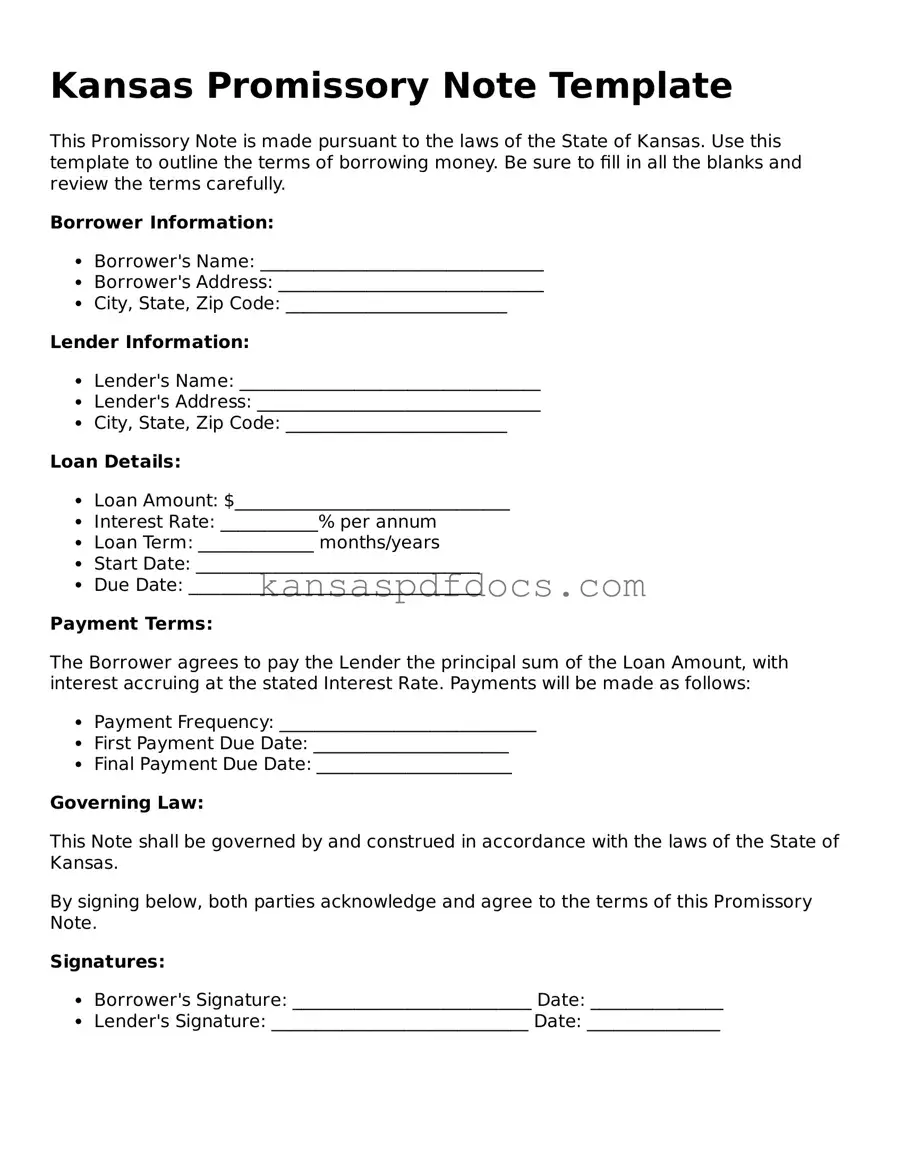

Valid Promissory Note Template for Kansas State

A Kansas Promissory Note is a written promise to pay a specific amount of money to a designated party at a defined time. This financial instrument serves as a crucial tool for both lenders and borrowers, outlining the terms of the loan agreement. Understanding its structure and requirements can help individuals navigate the borrowing process more effectively.

Access This Form Now

Valid Promissory Note Template for Kansas State

Access This Form Now

Your form isn’t ready yet

Edit and finalize Promissory Note online without printing.

Access This Form Now

or

Get PDF Form