Download Kansas W 9 Form

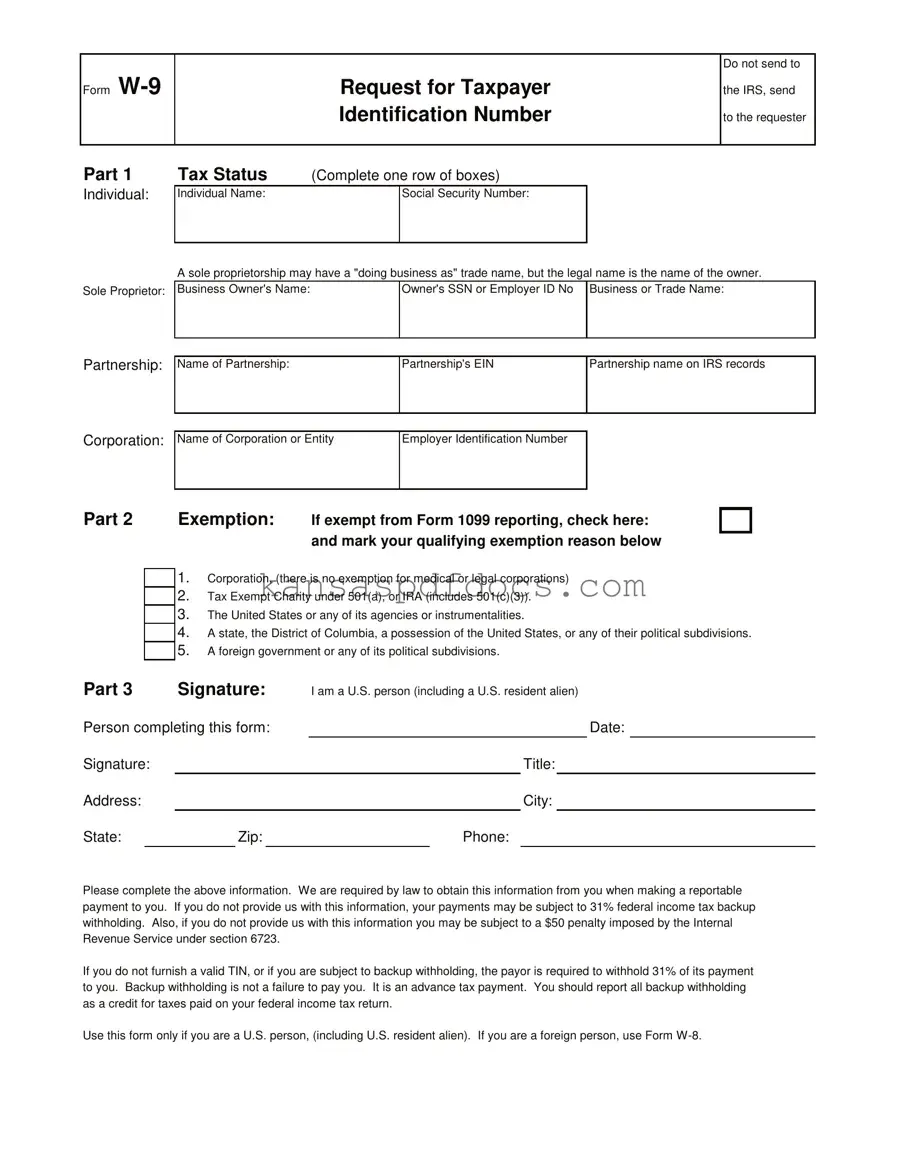

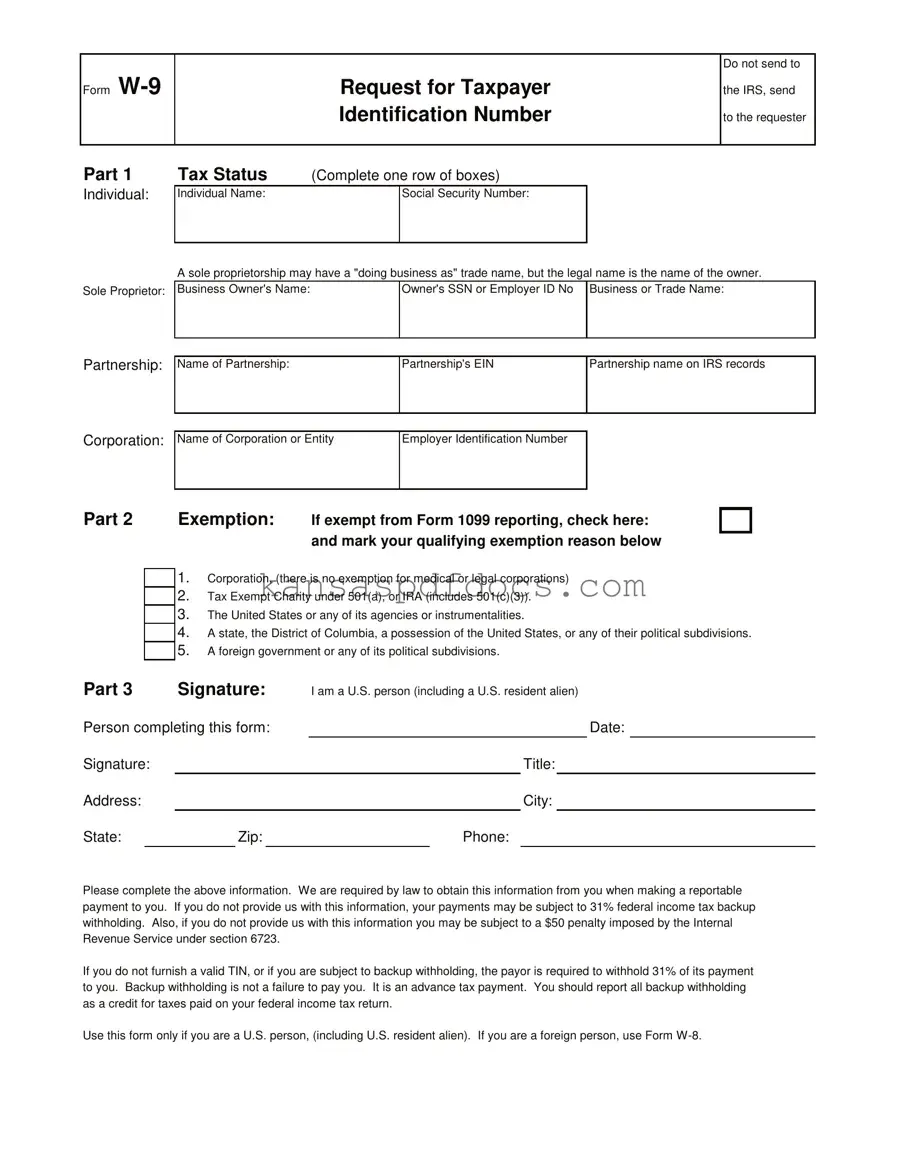

The Kansas W-9 form is a request for taxpayer identification information used primarily by businesses to obtain essential details from individuals or entities they pay. This form collects information such as the individual's name, social security number, and tax status, which helps ensure compliance with tax reporting requirements. Completing the Kansas W-9 accurately is vital, as it can impact tax withholding and reporting obligations.

Access This Form Now

Download Kansas W 9 Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize Kansas W 9 online without printing.

Access This Form Now

or

Get PDF Form