Download Kansas St 28W Form

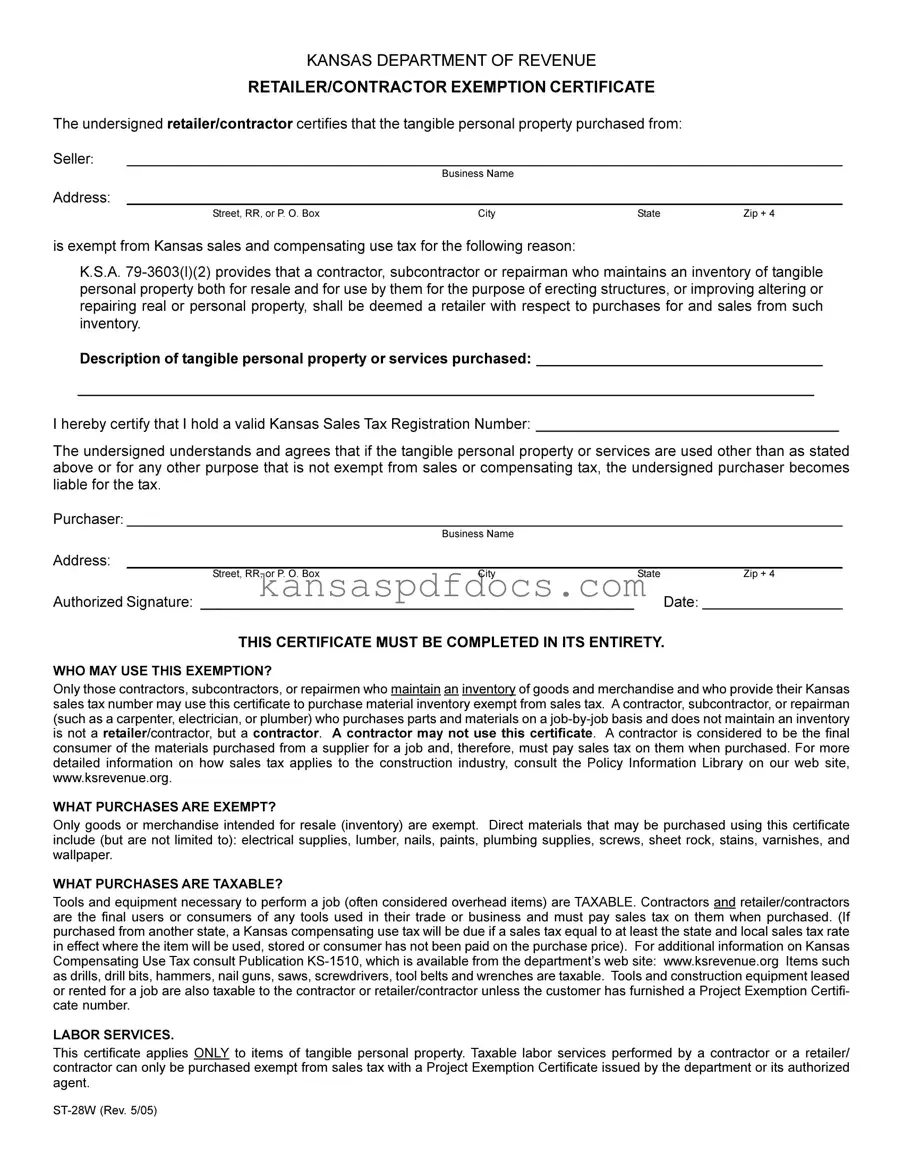

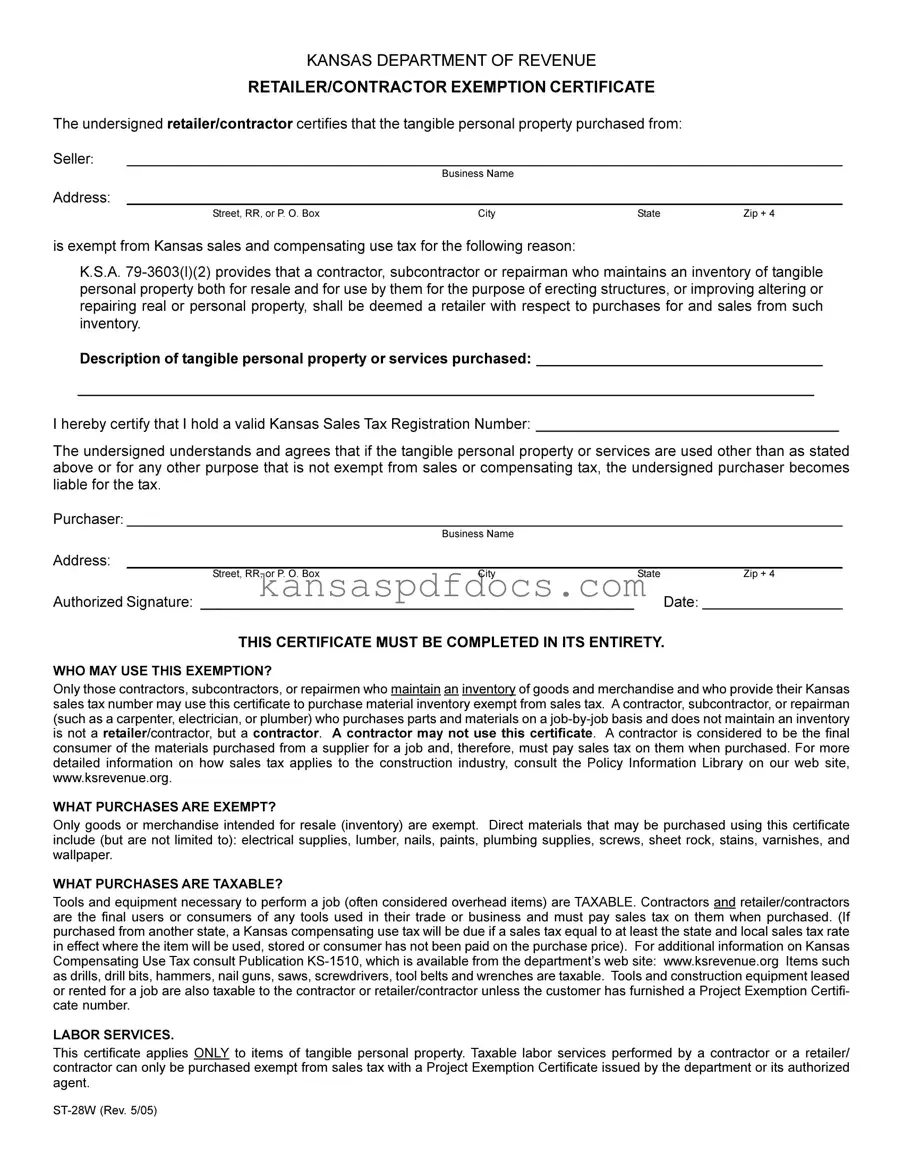

The Kansas St 28W form is a Retailer/Contractor Exemption Certificate that allows certain contractors, subcontractors, and repairmen to purchase tangible personal property without paying sales tax. This form is crucial for those who maintain an inventory of goods intended for resale or use in their projects. Understanding how to properly utilize this certificate can lead to significant savings for businesses in the construction industry.

Access This Form Now

Download Kansas St 28W Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize Kansas St 28W online without printing.

Access This Form Now

or

Get PDF Form