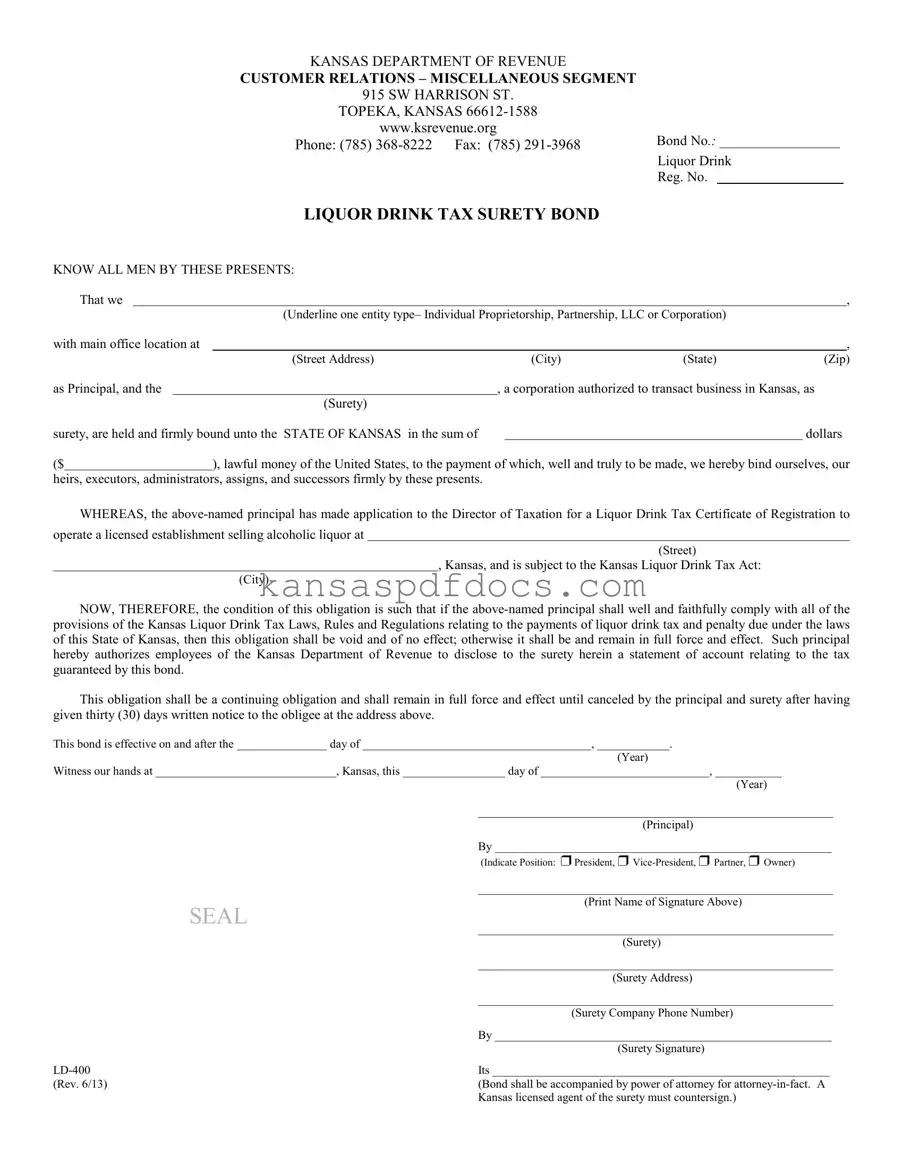

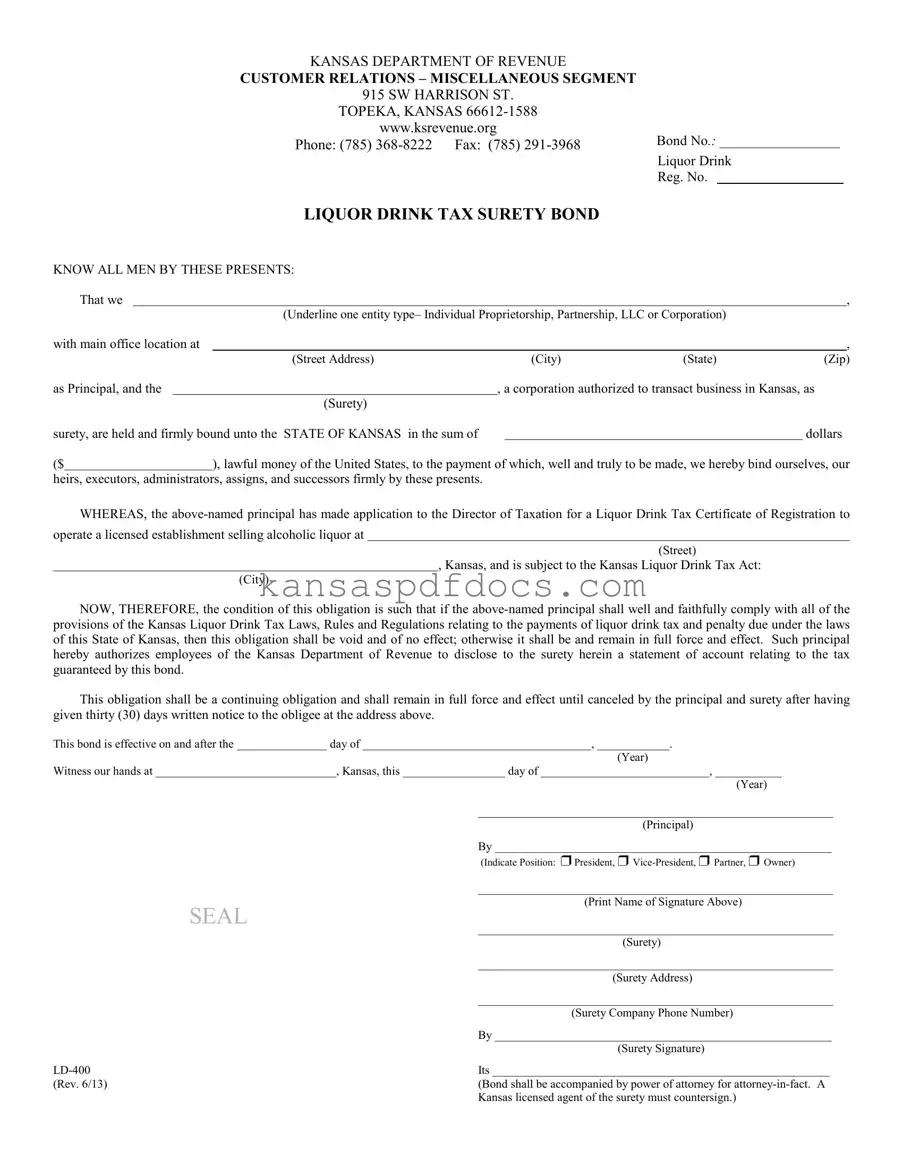

Download Kansas Ld 400 Form

The Kansas LD 400 form is a Liquor Drink Tax Surety Bond required for establishments selling alcoholic beverages in Kansas. This form ensures compliance with the Kansas Liquor Drink Tax Act by binding the principal and surety to the state’s regulations. Understanding its requirements and proper completion is essential for any business seeking to operate legally in the liquor industry.

Access This Form Now

Download Kansas Ld 400 Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize Kansas Ld 400 online without printing.

Access This Form Now

or

Get PDF Form