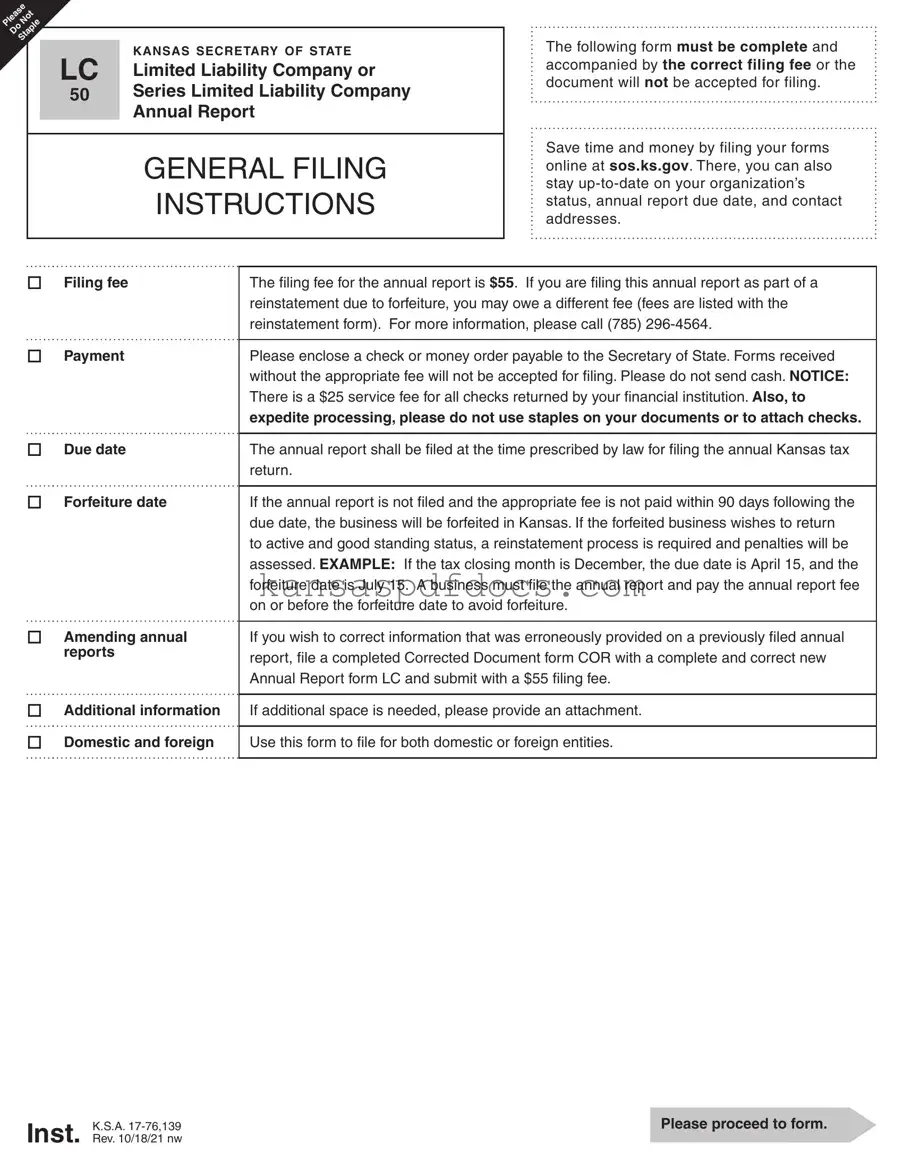

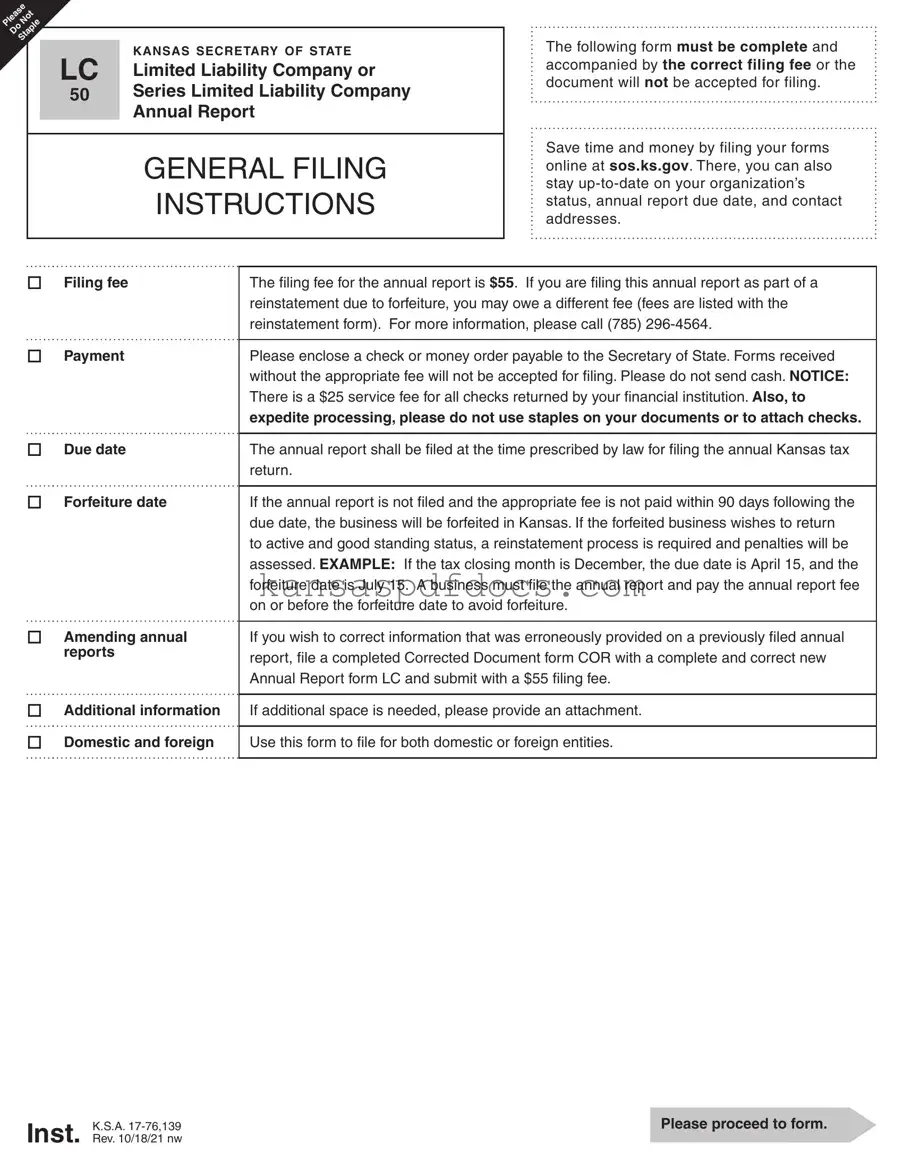

Download Kansas Lc 50 Form

The Kansas LC 50 form is the annual report required for Limited Liability Companies (LLCs) or 50 Series Limited Liability Companies operating in Kansas. This form must be completed accurately and submitted with the appropriate filing fee to maintain good standing with the state. Failure to file on time may result in forfeiture of the business entity.

Access This Form Now

Download Kansas Lc 50 Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize Kansas Lc 50 online without printing.

Access This Form Now

or

Get PDF Form