Download Kansas K Ben 3211 Form

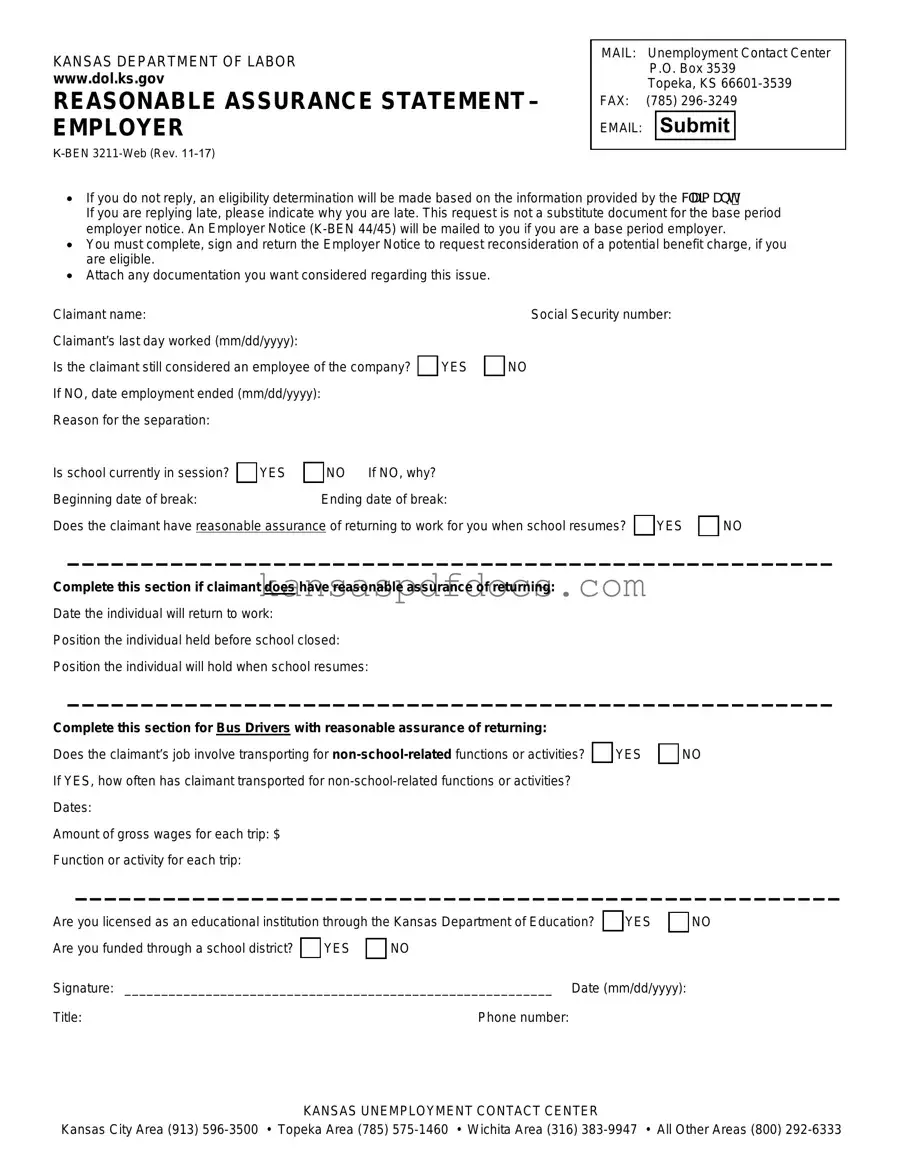

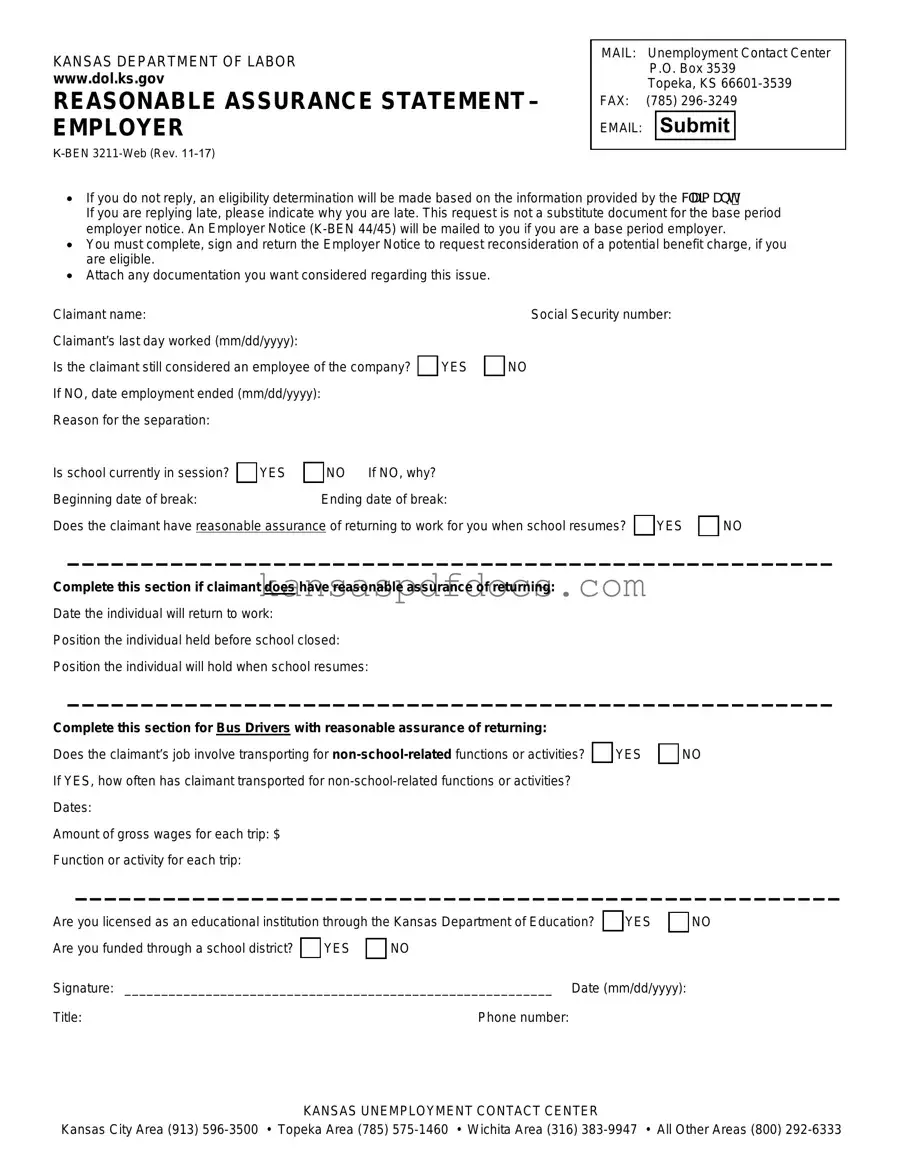

The Kansas K Ben 3211 form is a Reasonable Assurance Statement used by employers to provide information regarding the employment status of individuals who may be eligible for unemployment benefits. This form is particularly relevant for educational institutions and their employees, as it helps determine whether a claimant has reasonable assurance of returning to work after a break, such as summer vacation. Completing this form accurately is crucial for both employers and employees to navigate the unemployment benefits process effectively.

Access This Form Now

Download Kansas K Ben 3211 Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize Kansas K Ben 3211 online without printing.

Access This Form Now

or

Get PDF Form