Download Kansas K 40Pt Form

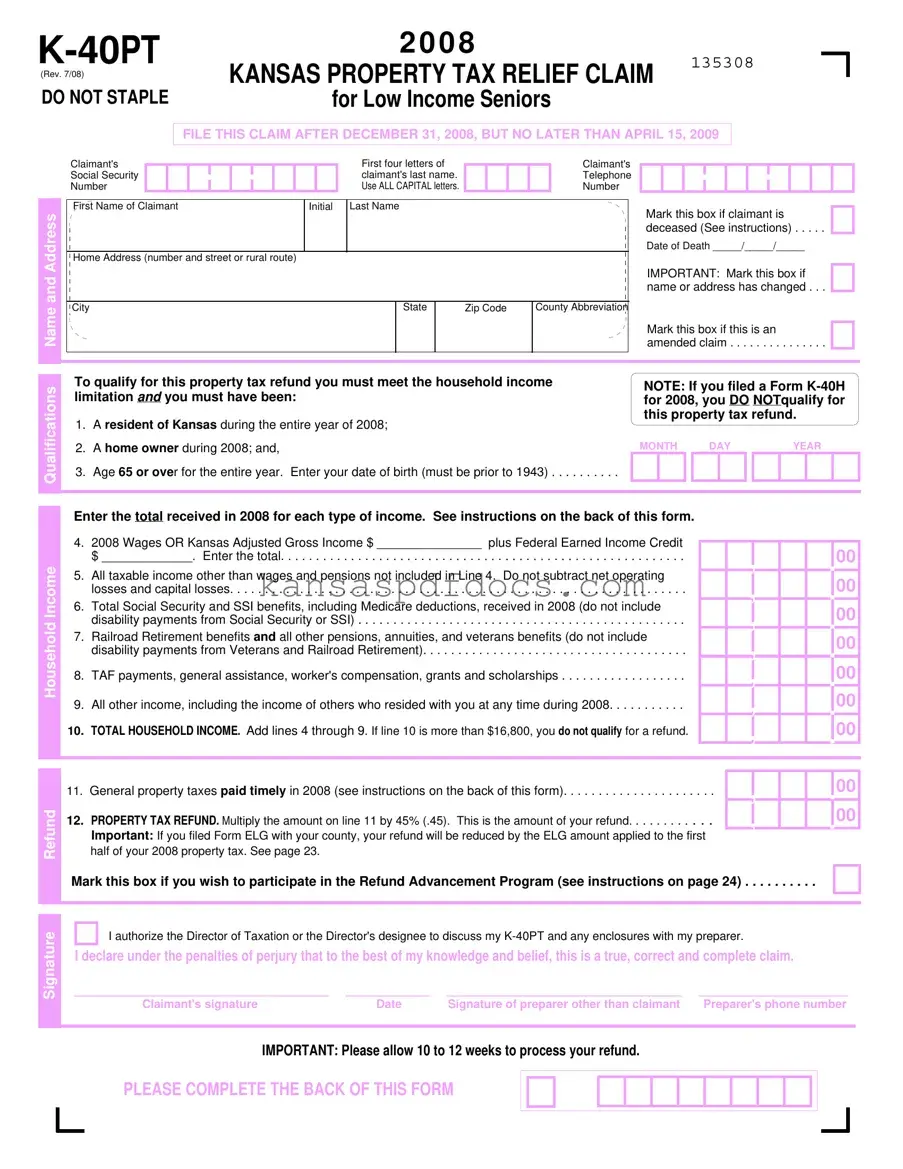

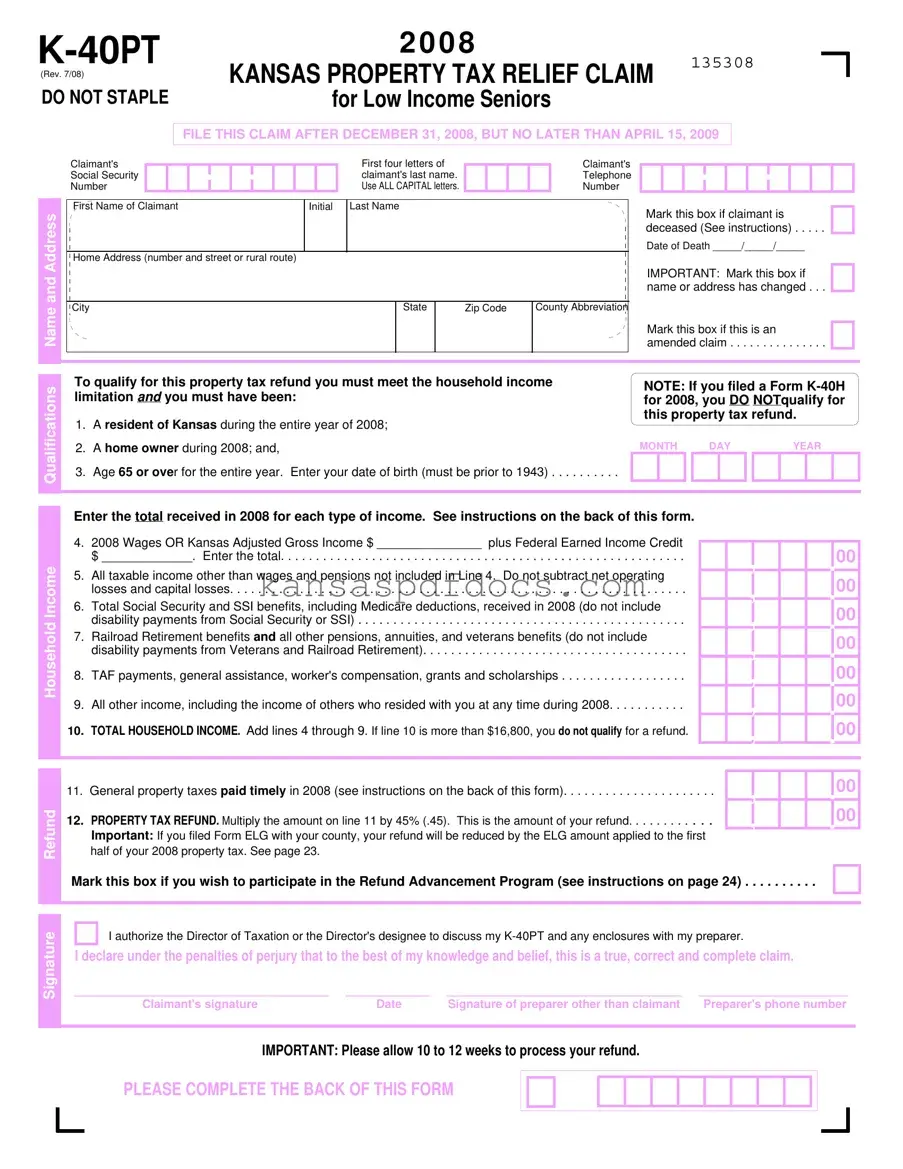

The Kansas K 40Pt form is a crucial document designed to help low-income seniors claim property tax relief in Kansas. This form must be filed after December 31, 2008, but no later than April 15, 2009, to ensure eligible homeowners receive their refunds. By providing essential information about household income and property taxes, the K 40Pt form plays a vital role in supporting those who need it most.

Access This Form Now

Download Kansas K 40Pt Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize Kansas K 40Pt online without printing.

Access This Form Now

or

Get PDF Form