Download Kansas K 40 Form

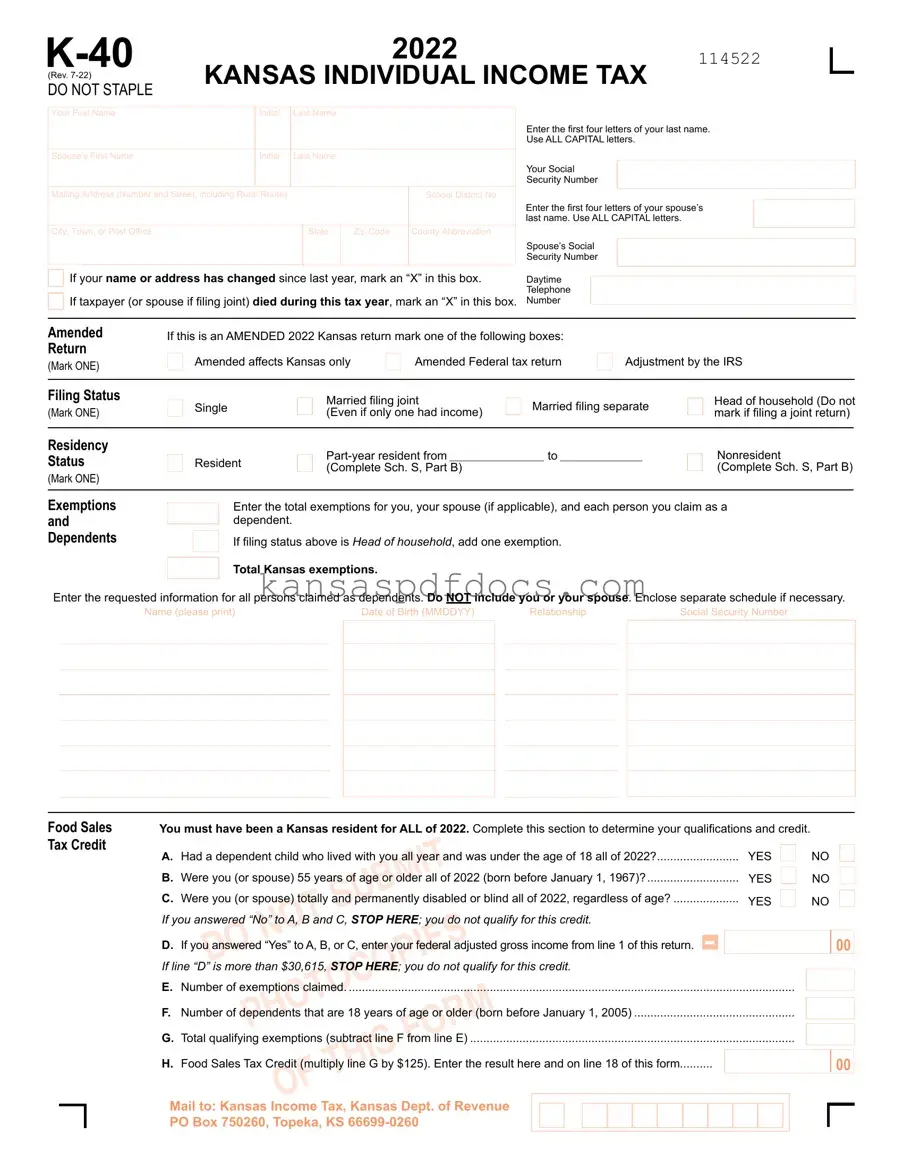

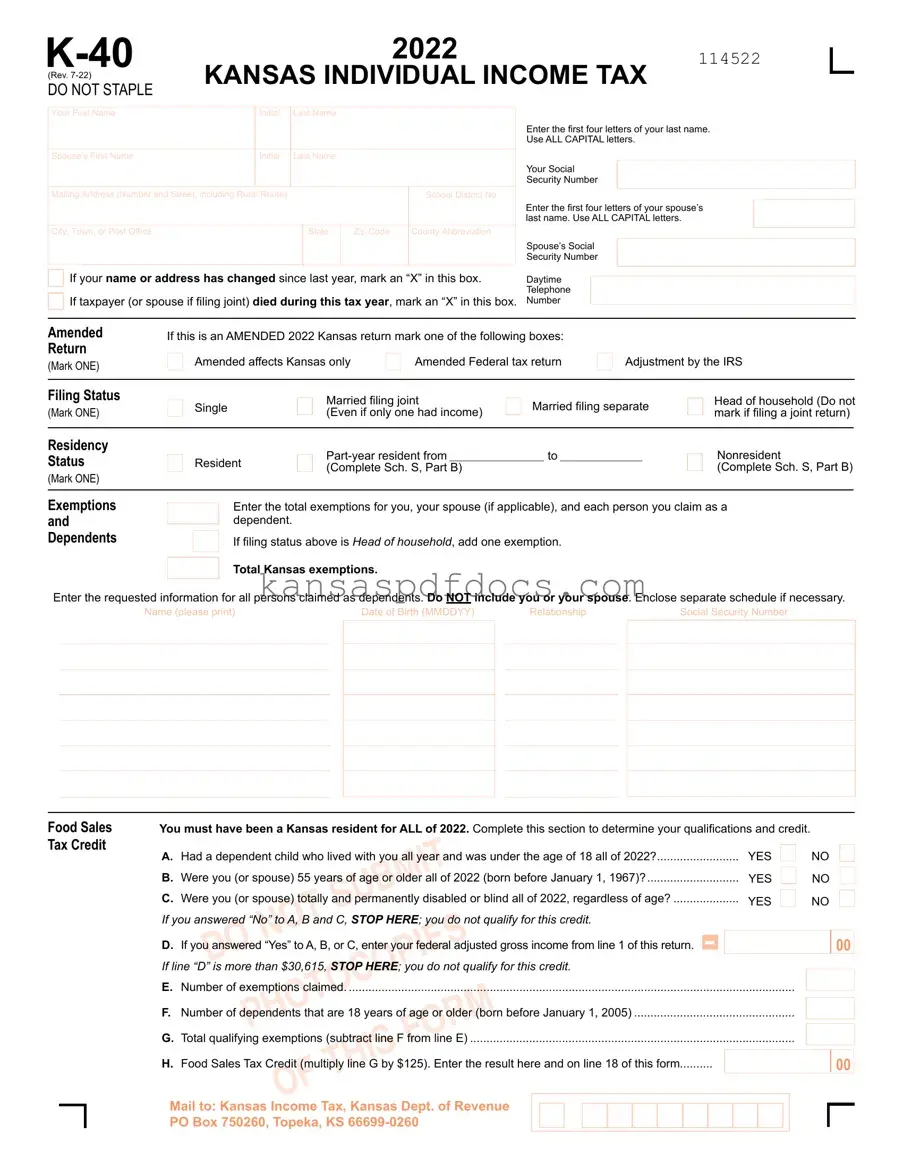

The Kansas K-40 form is the official document used for filing individual income tax returns in the state of Kansas. This form requires taxpayers to provide personal information, including their names, addresses, and Social Security numbers, as well as details about their income and any applicable deductions or credits. Understanding the K-40 form is essential for ensuring accurate tax reporting and compliance with state regulations.

Access This Form Now

Download Kansas K 40 Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize Kansas K 40 online without printing.

Access This Form Now

or

Get PDF Form