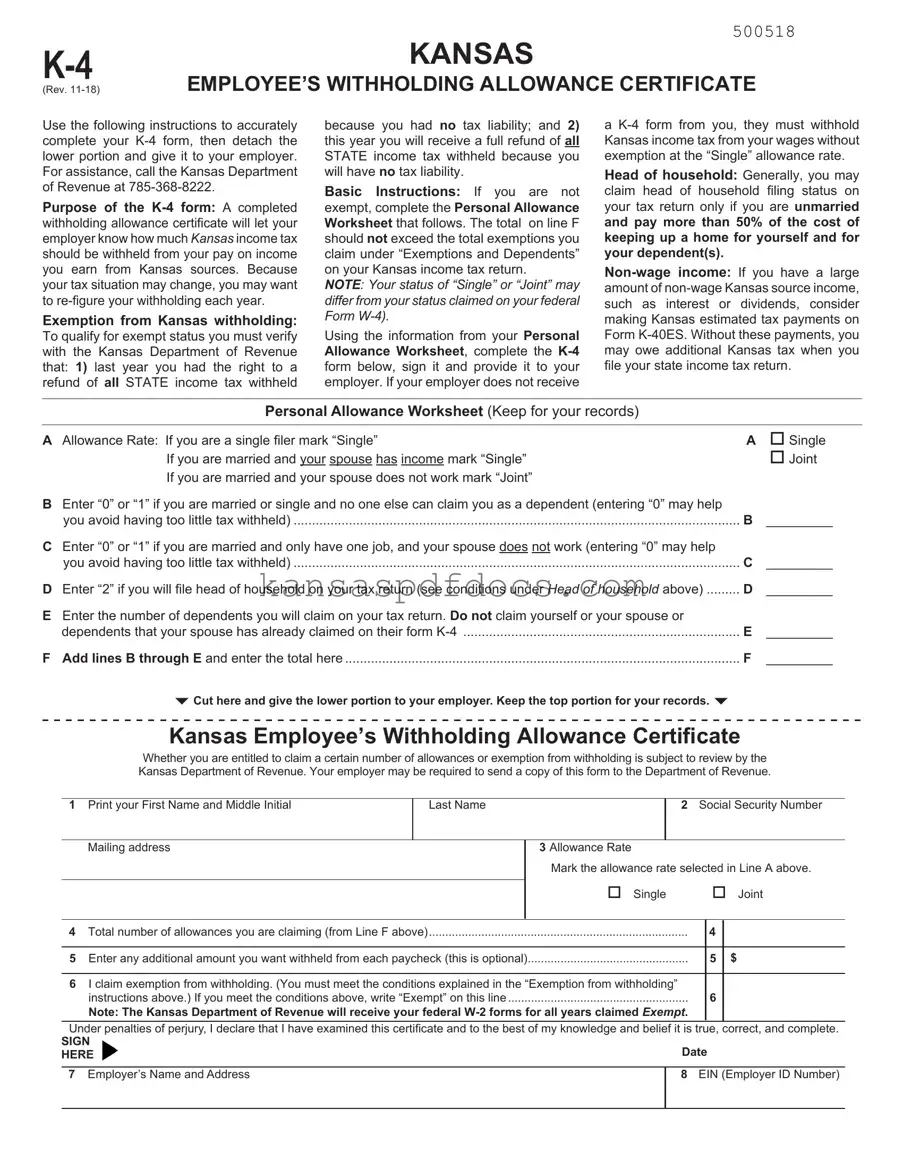

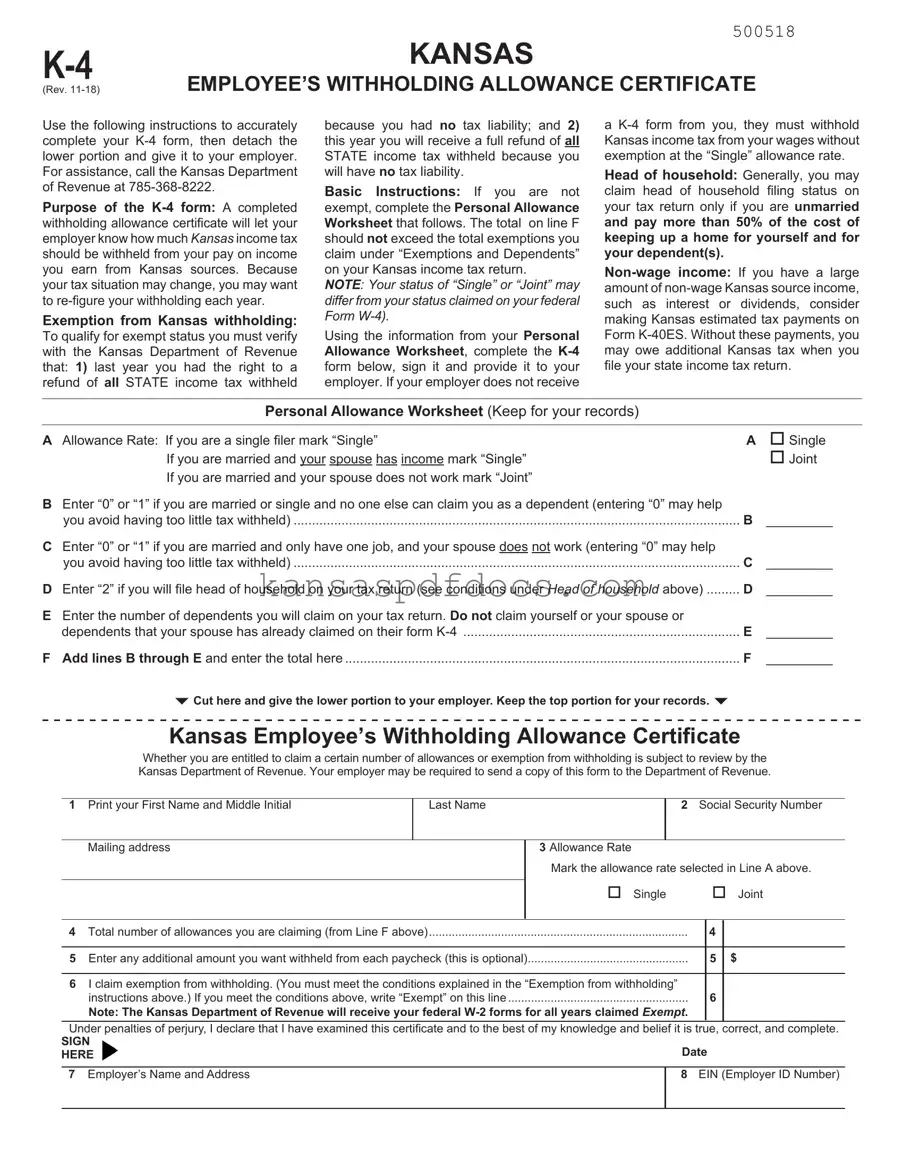

Download Kansas K 4 Form

The Kansas K-4 form is an essential document known as the Employee’s Withholding Allowance Certificate. It helps your employer determine how much Kansas income tax to withhold from your paycheck based on your individual tax situation. Completing this form accurately can ensure that you pay the right amount of tax throughout the year, avoiding surprises when tax season arrives.

Access This Form Now

Download Kansas K 4 Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize Kansas K 4 online without printing.

Access This Form Now

or

Get PDF Form