Download Kansas K 30 Form

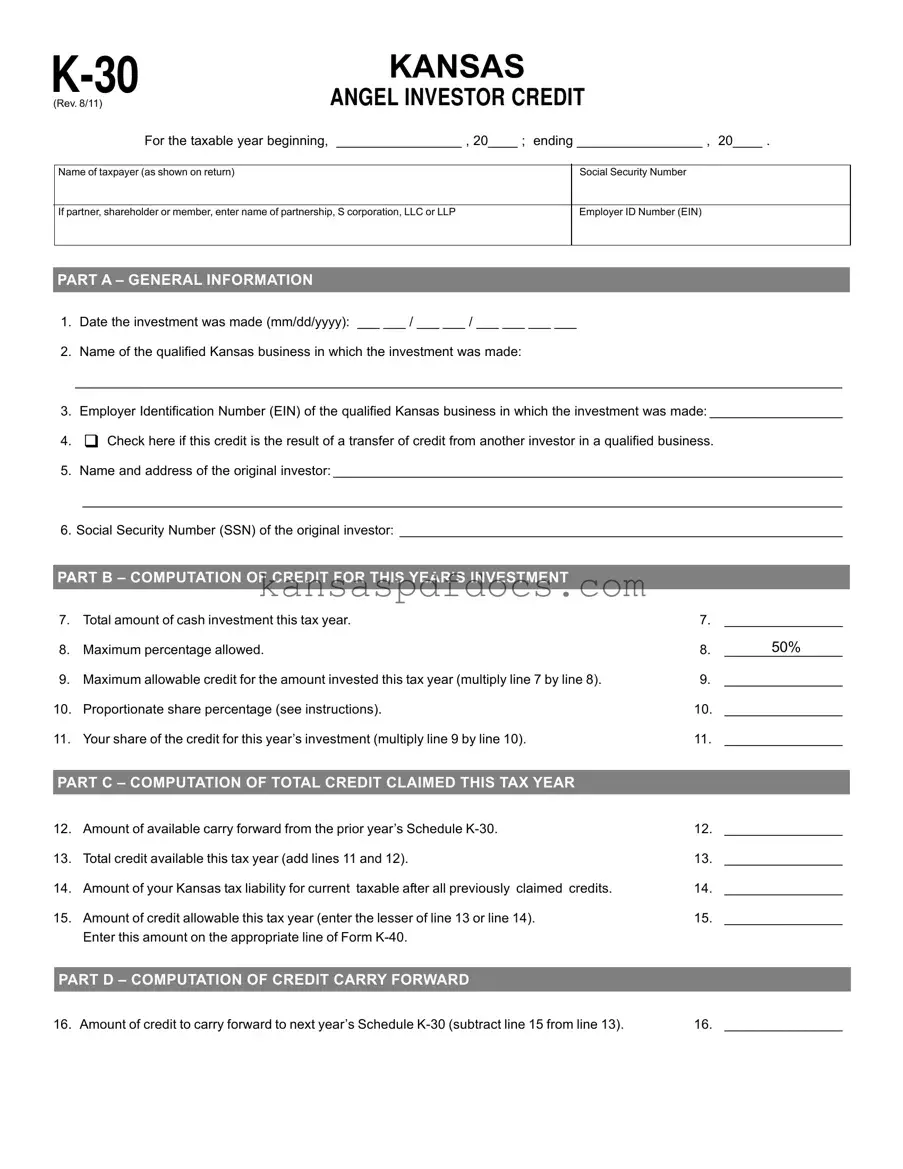

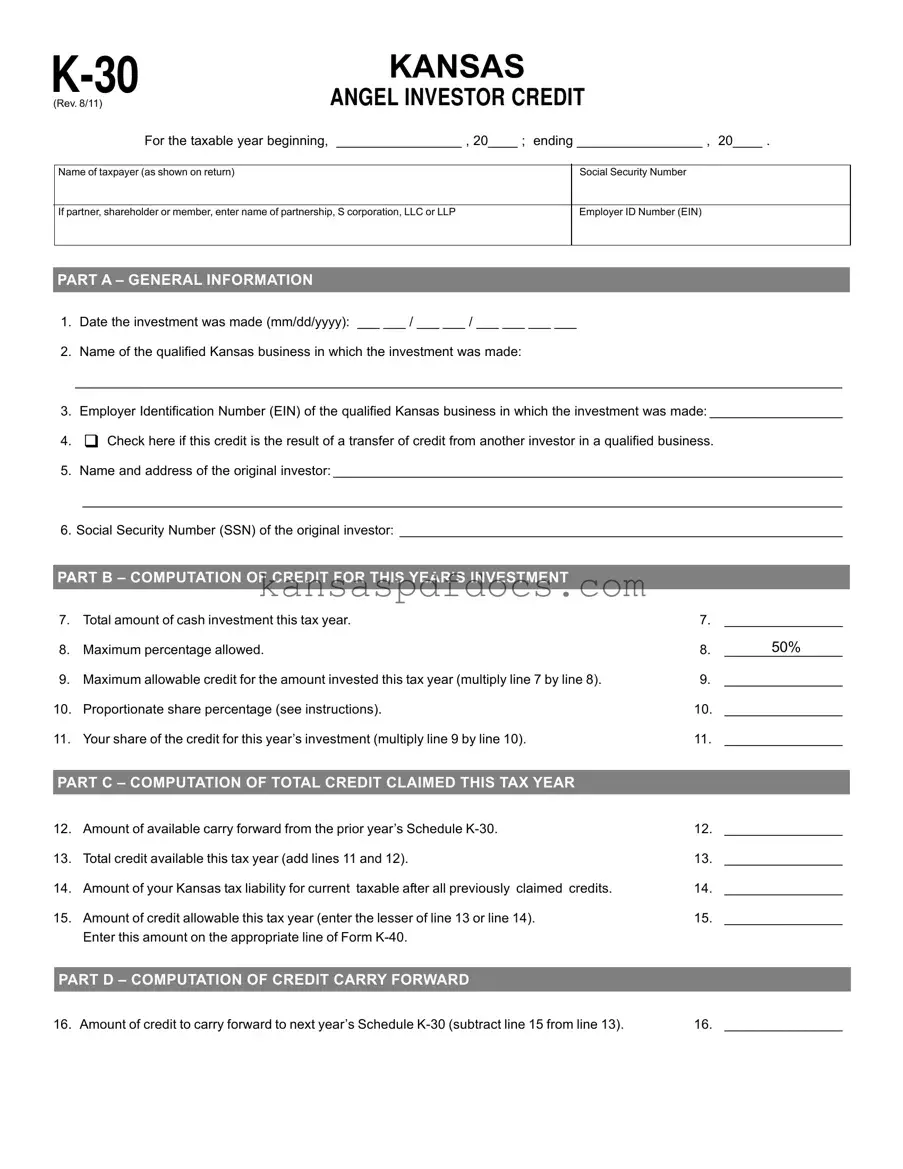

The Kansas K-30 form is used to claim the Angel Investor Credit for investments made in qualified Kansas businesses. This form allows taxpayers to report their cash investments and calculate the tax credits they are eligible for, facilitating support for local startups. Understanding the K-30 form is essential for investors looking to maximize their benefits while contributing to the Kansas economy.

Access This Form Now

Download Kansas K 30 Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize Kansas K 30 online without printing.

Access This Form Now

or

Get PDF Form