Download Kansas K 19 Form

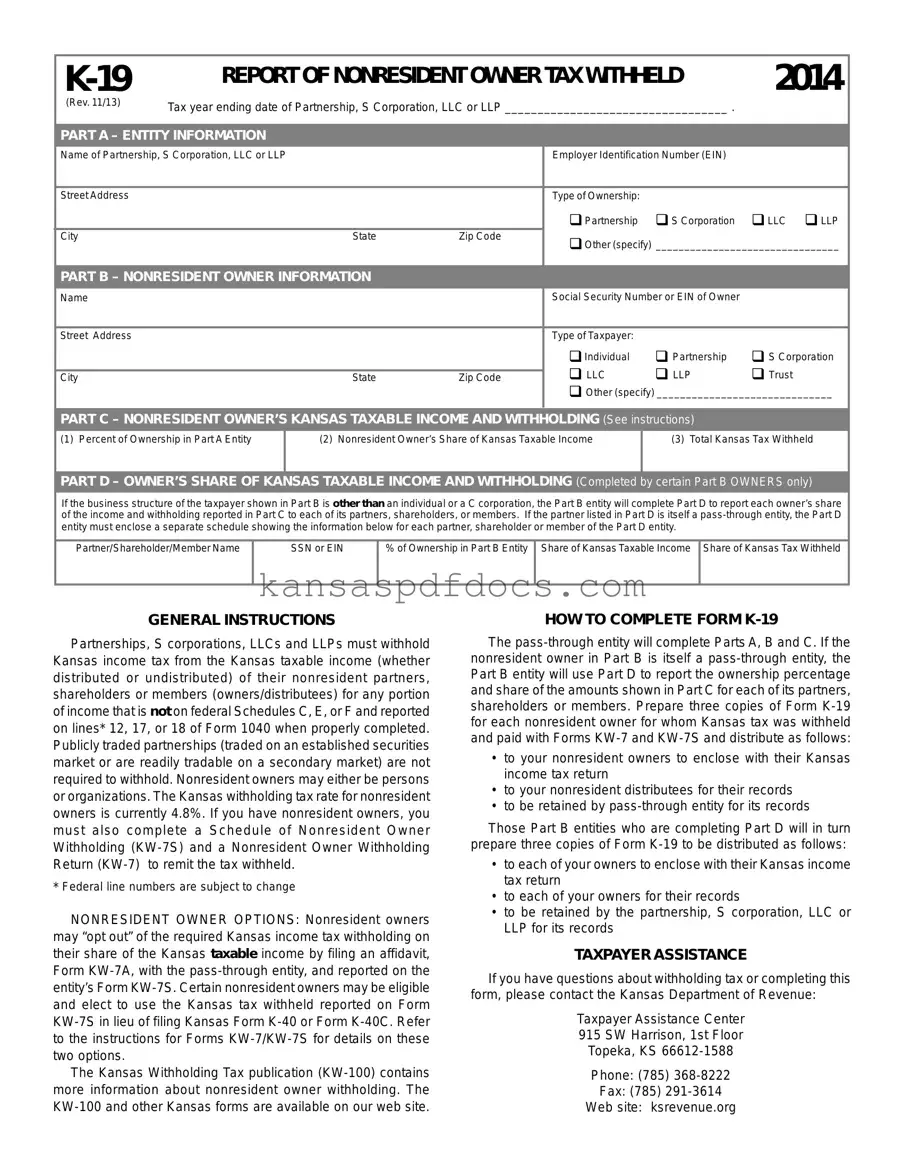

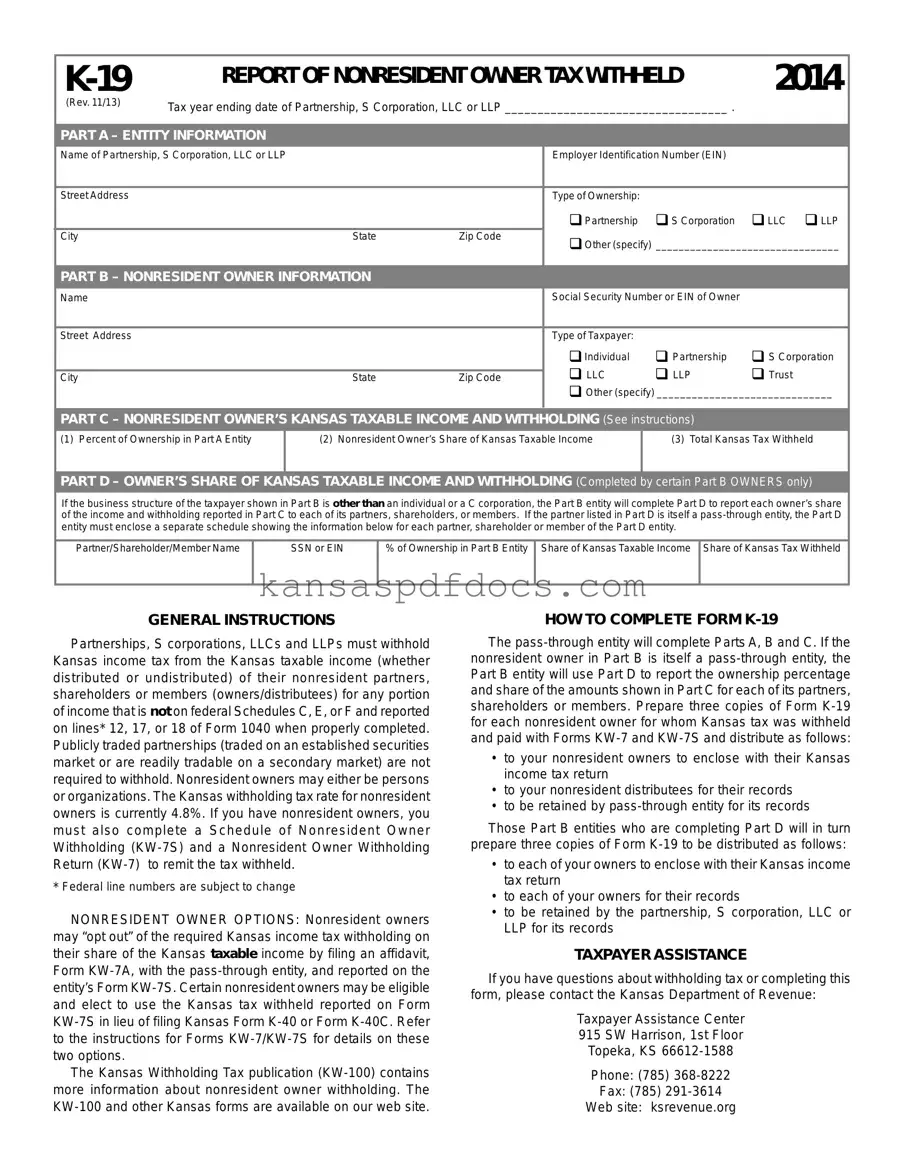

The Kansas K-19 form is a document used to report the income tax withheld from nonresident owners of partnerships, S corporations, LLCs, or LLPs. This form is essential for ensuring compliance with Kansas tax laws, as it outlines the necessary information regarding the entity and its nonresident owners. By accurately completing the K-19, businesses can effectively manage their tax obligations while providing nonresident owners with the required documentation for their tax returns.

Access This Form Now

Download Kansas K 19 Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize Kansas K 19 online without printing.

Access This Form Now

or

Get PDF Form