Download Kansas Interim Report Form

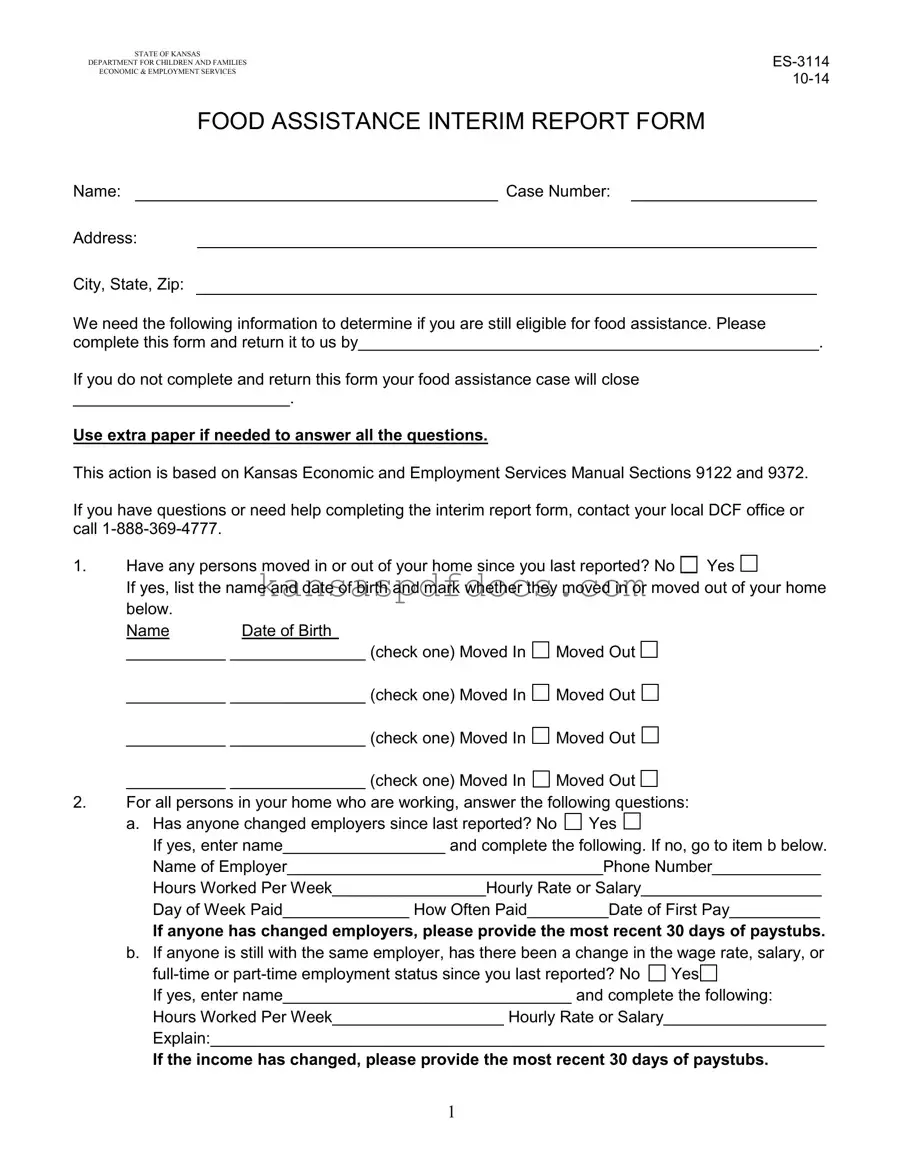

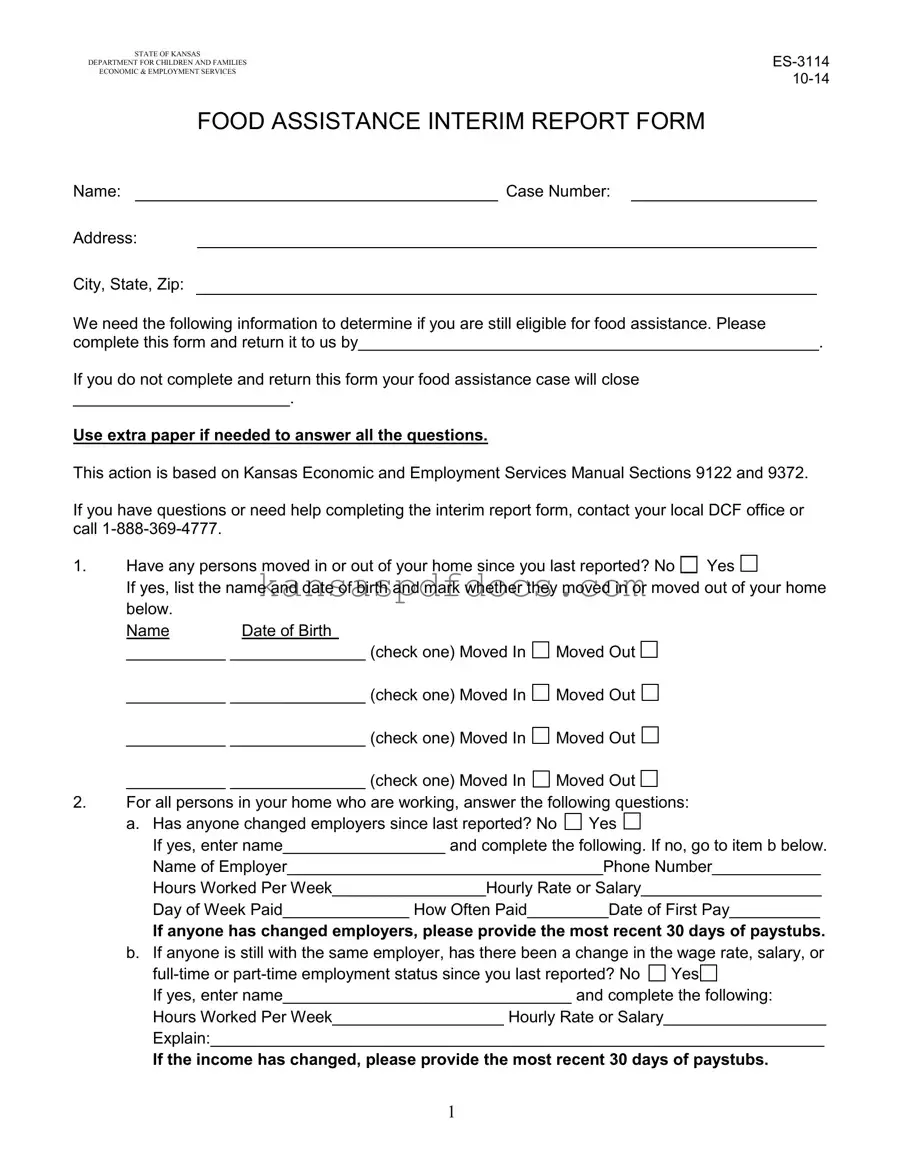

The Kansas Interim Report form is a document used by the Department for Children and Families to assess ongoing eligibility for food assistance. Completing this form is essential for individuals receiving assistance, as it collects vital information about household changes, employment status, and income. Failure to submit the form may result in the closure of the food assistance case.

Access This Form Now

Download Kansas Interim Report Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize Kansas Interim Report online without printing.

Access This Form Now

or

Get PDF Form