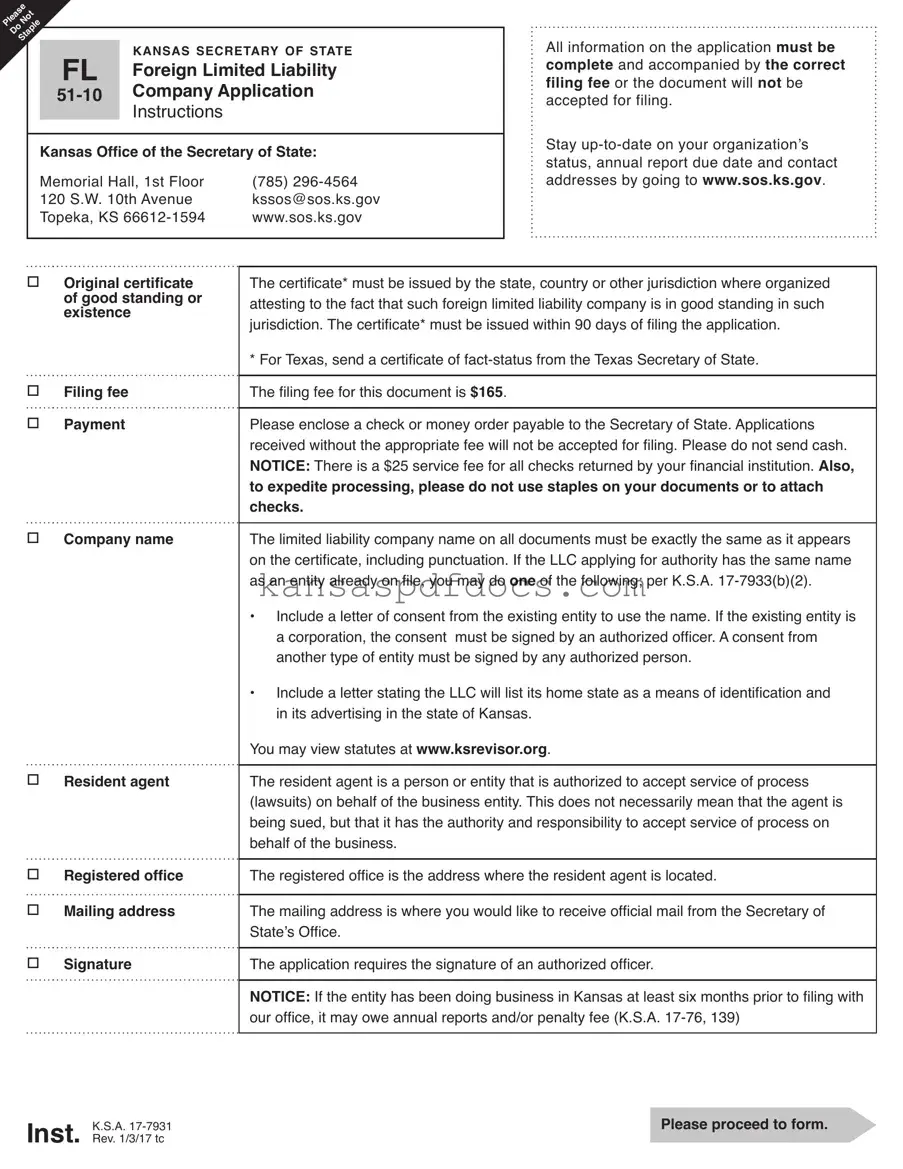

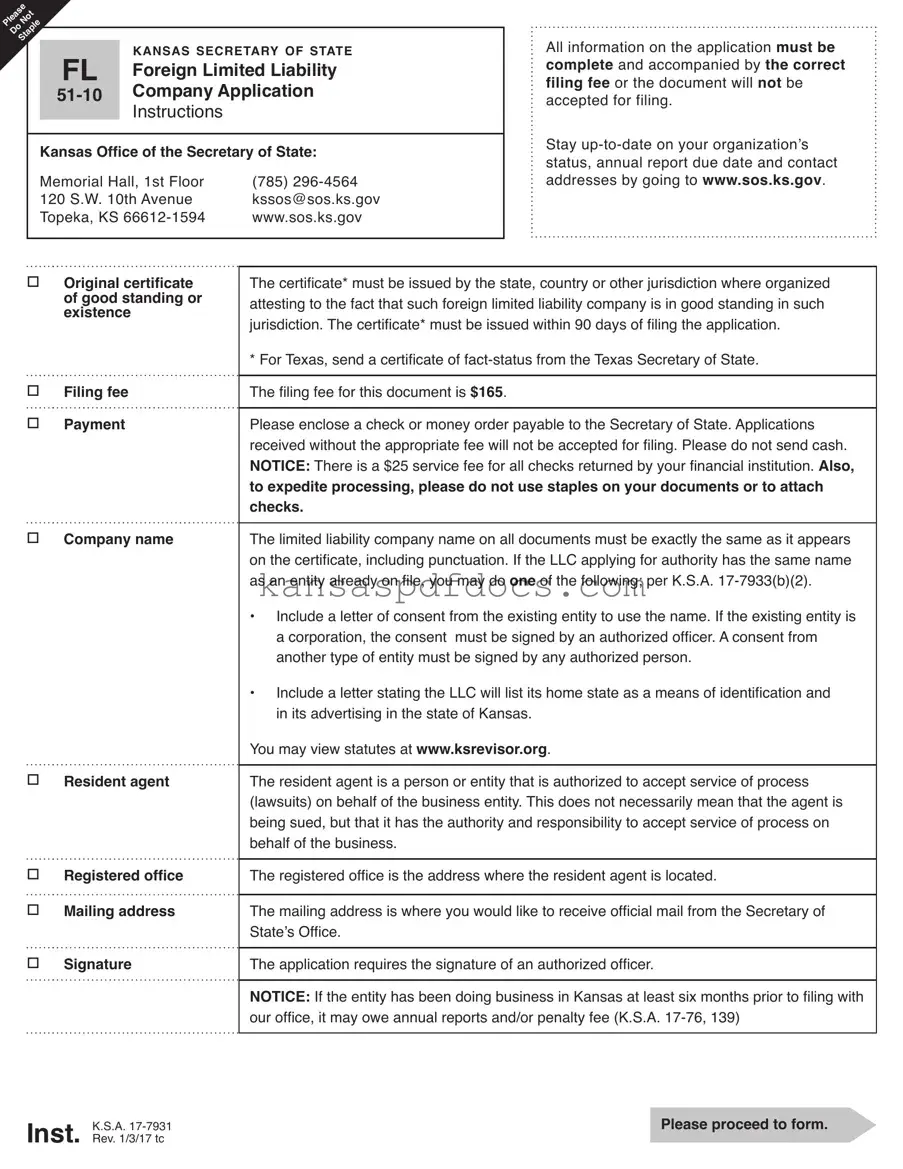

Download Kansas Fl 51 10 Form

The Kansas Fl 51 10 form is an application used by foreign limited liability companies to register their business in the state of Kansas. This form requires specific information, including the company name, resident agent details, and a certificate of good standing from the home jurisdiction. Accurate completion and submission of the form, along with the appropriate filing fee, are essential for successful registration.

Access This Form Now

Download Kansas Fl 51 10 Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize Kansas Fl 51 10 online without printing.

Access This Form Now

or

Get PDF Form