Download Kansas Fa 51 03 Form

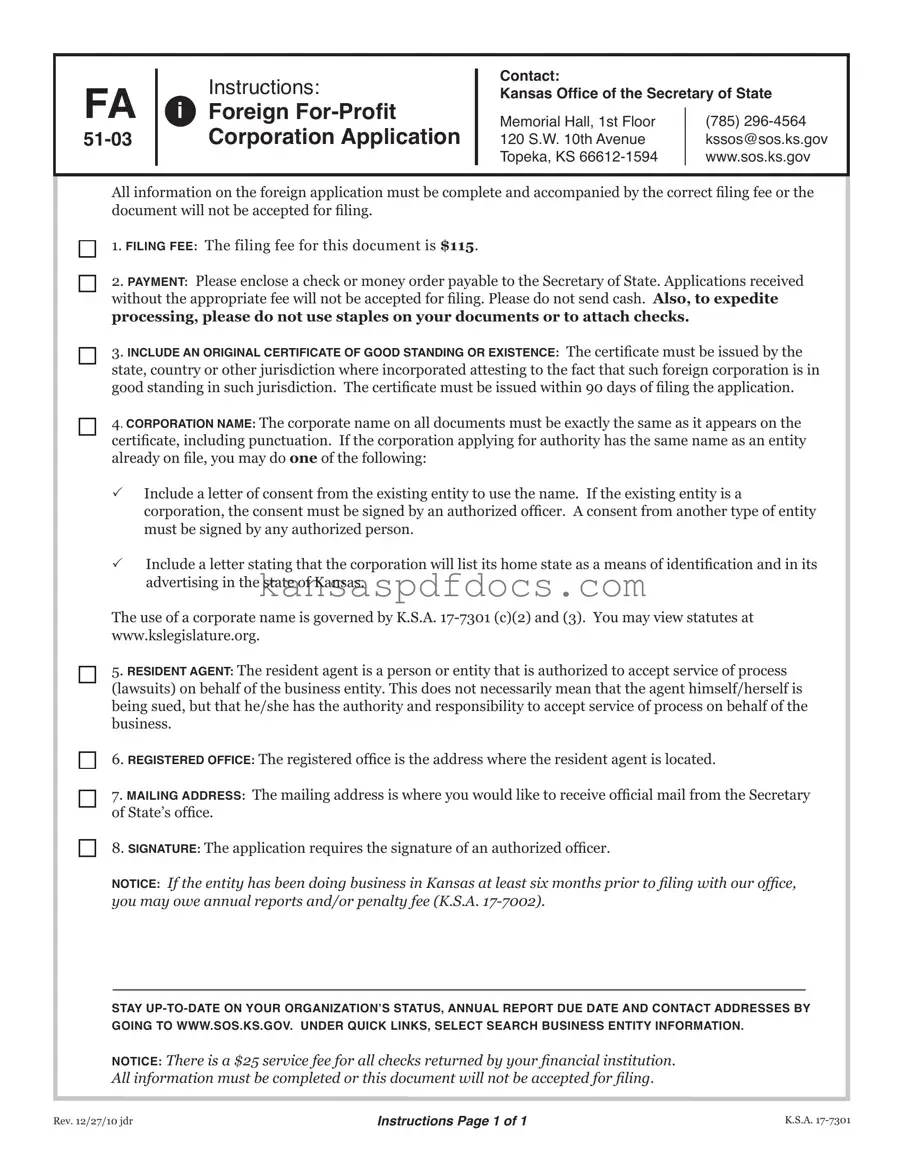

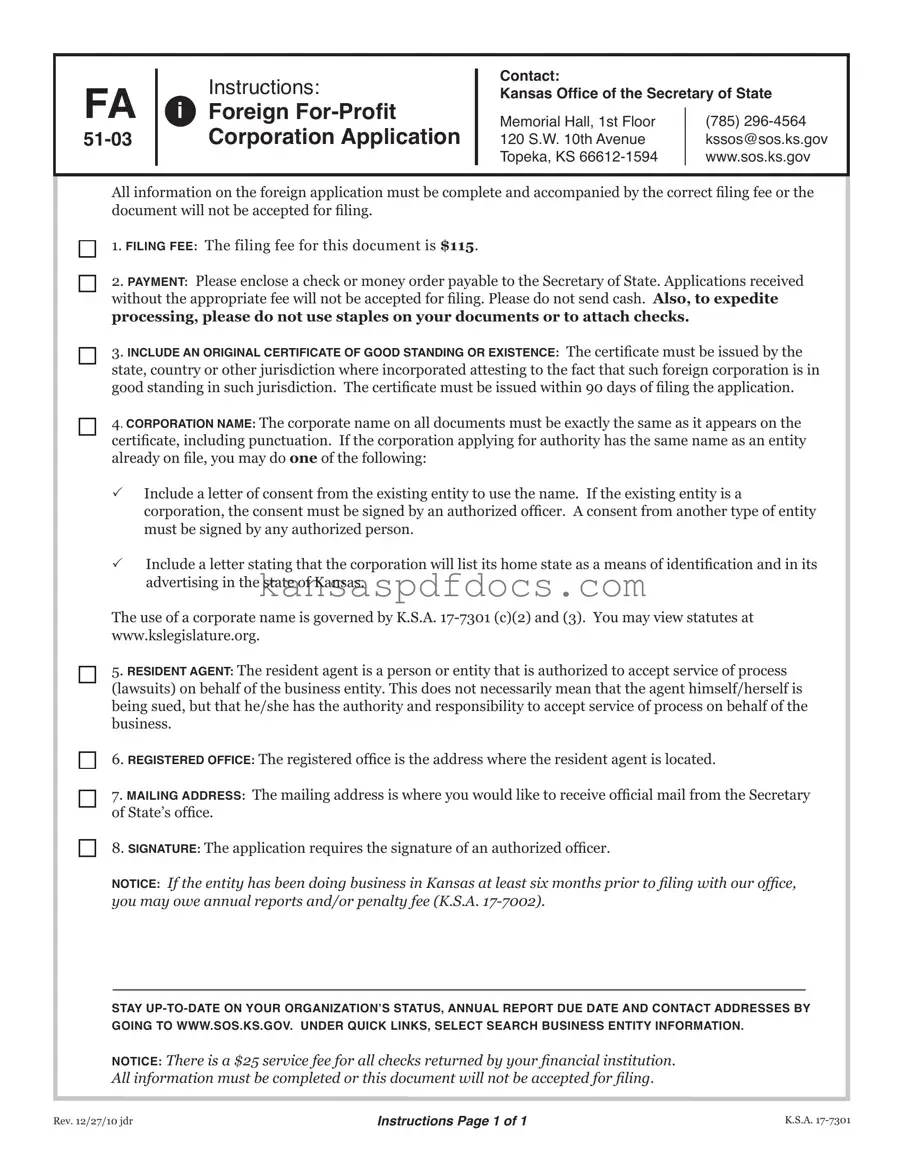

The Kansas FA 51 03 form is an application used by foreign for-profit corporations seeking to operate within the state of Kansas. This form must be completed accurately and submitted with the appropriate filing fee to ensure acceptance by the Secretary of State's office. Understanding the requirements and process outlined in this form is essential for businesses aiming to establish a presence in Kansas.

Access This Form Now

Download Kansas Fa 51 03 Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize Kansas Fa 51 03 online without printing.

Access This Form Now

or

Get PDF Form