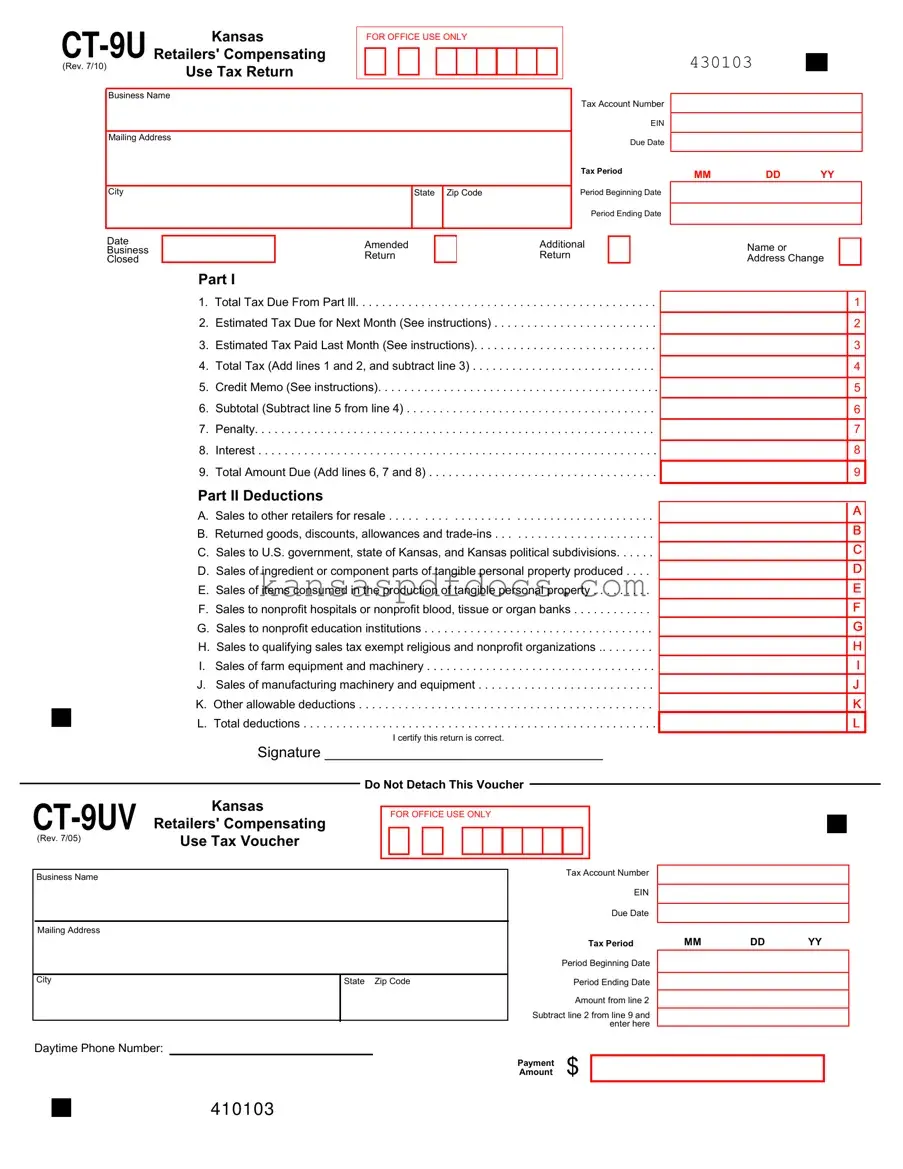

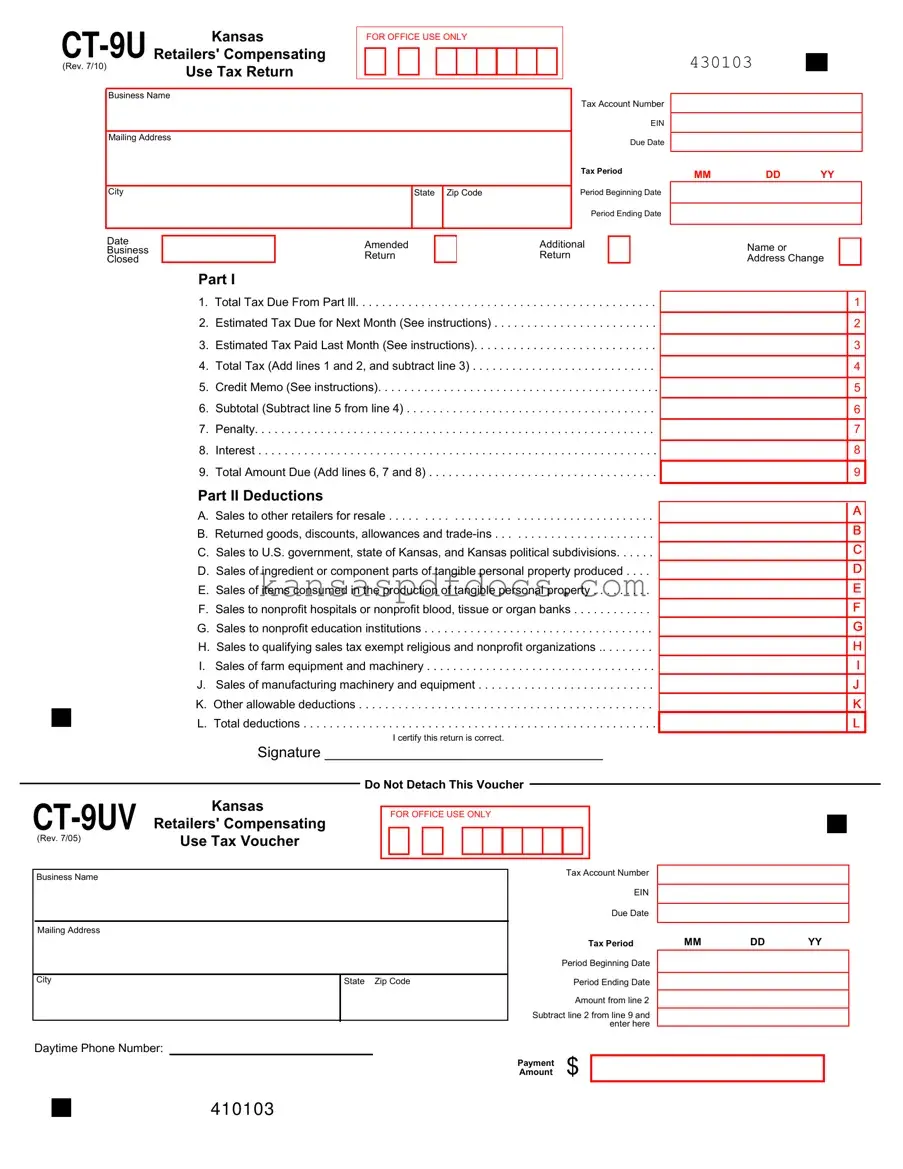

Download Kansas Ct 9U Form

The Kansas Ct 9U form is a tax return document used by retailers to report compensating use tax in the state of Kansas. This form allows businesses to calculate their total tax due, deductions, and any penalties or interest owed. Accurate completion of the form is essential for compliance with Kansas tax regulations.

Access This Form Now

Download Kansas Ct 9U Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize Kansas Ct 9U online without printing.

Access This Form Now

or

Get PDF Form