Download Kansas Cr 16 Form

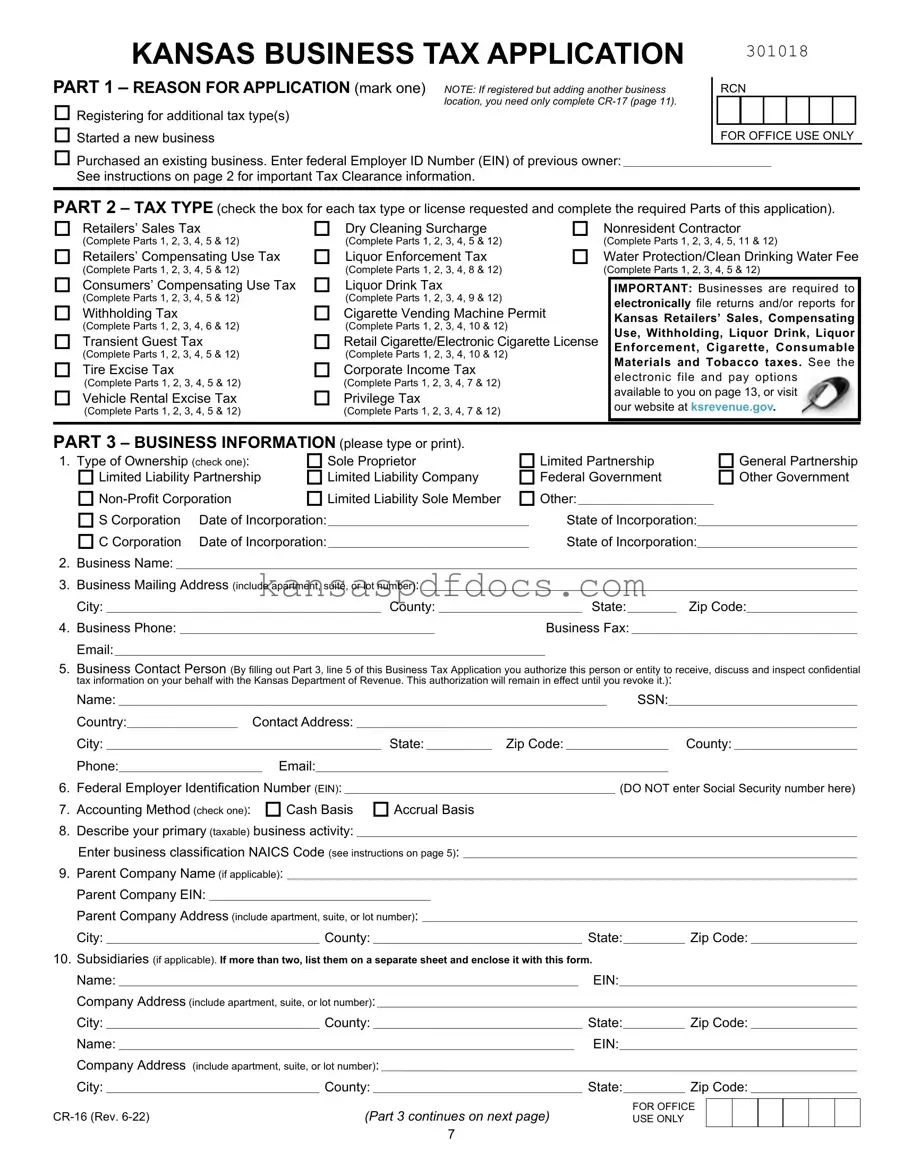

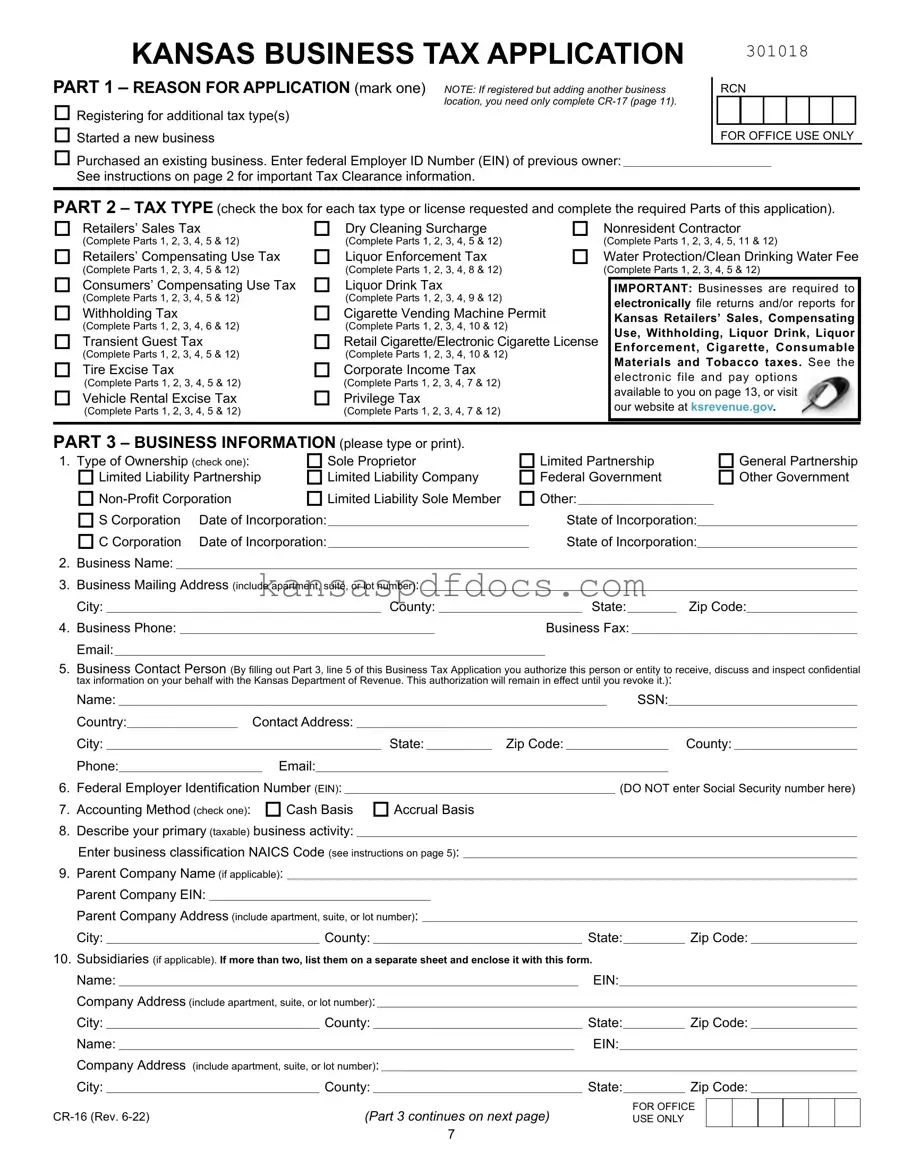

The Kansas Cr 16 form is a crucial document for businesses seeking to register for various tax types in the state of Kansas. This application serves as a means to officially register a new business, add an additional tax type, or take over an existing business. Completing this form accurately is essential to ensure compliance with state tax regulations and to avoid any potential issues down the line.

Access This Form Now

Download Kansas Cr 16 Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize Kansas Cr 16 online without printing.

Access This Form Now

or

Get PDF Form