Download Kansas Al 30 Form

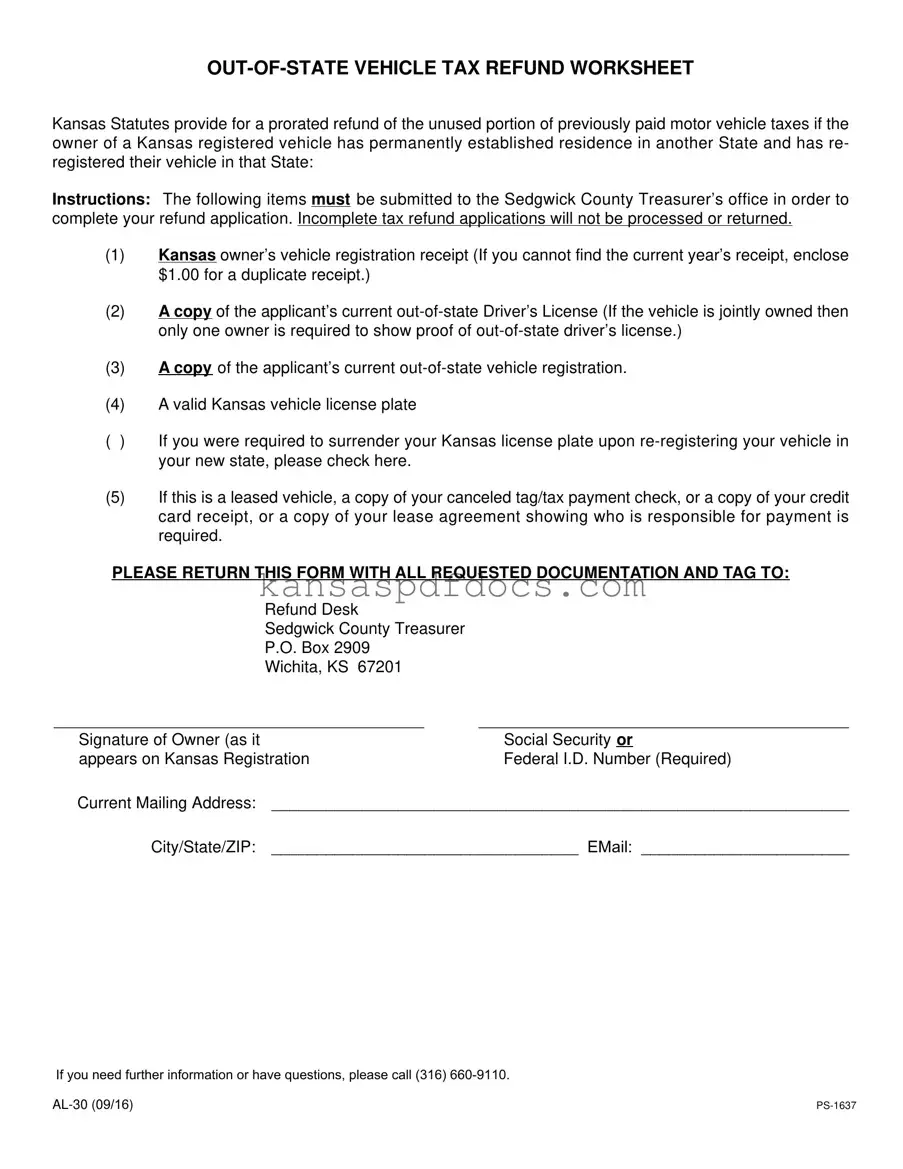

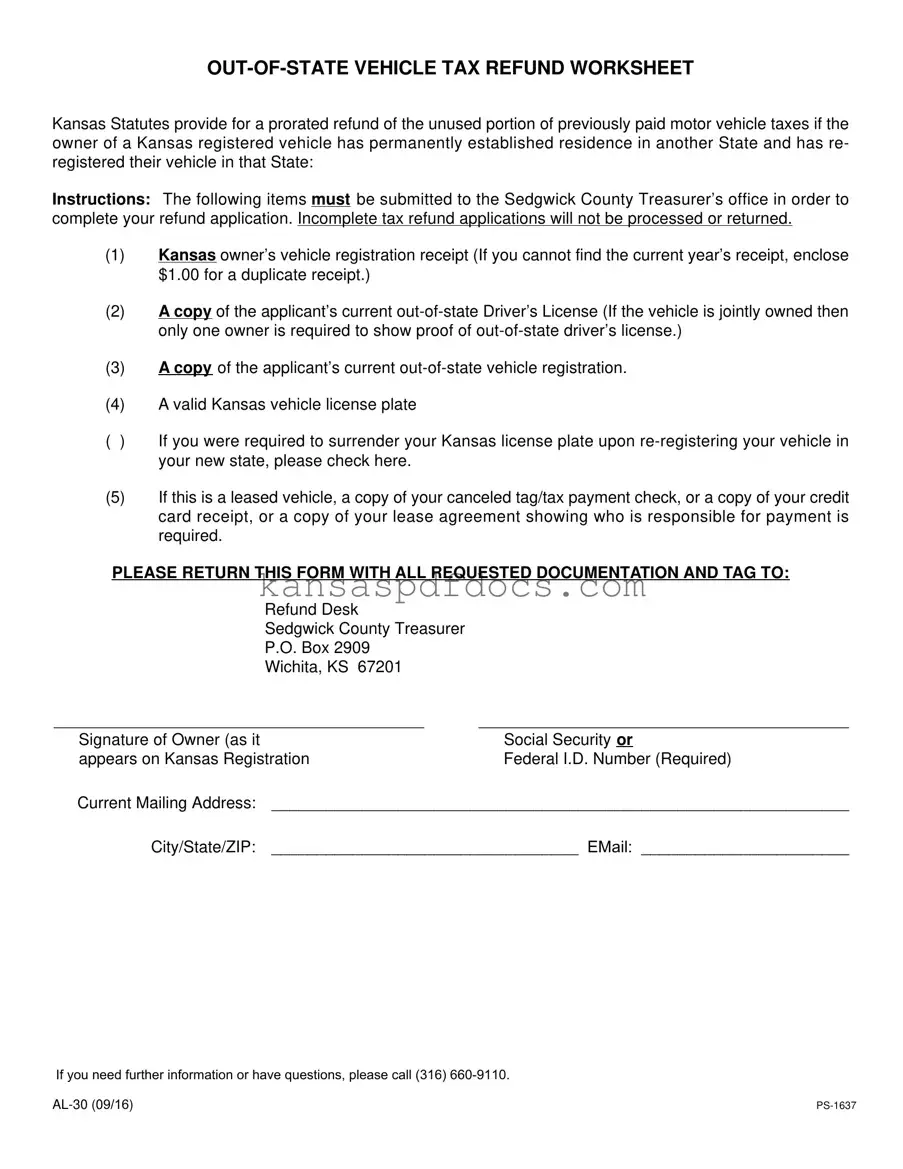

The Kansas AL 30 form is a worksheet designed for individuals seeking a refund of unused motor vehicle taxes after moving out of state. If you have registered your vehicle in a new state and established permanent residency there, you may be eligible for a prorated refund of the taxes you previously paid in Kansas. This article will guide you through the necessary steps and documentation required to successfully complete your refund application.

Access This Form Now

Download Kansas Al 30 Form

Access This Form Now

Your form isn’t ready yet

Edit and finalize Kansas Al 30 online without printing.

Access This Form Now

or

Get PDF Form