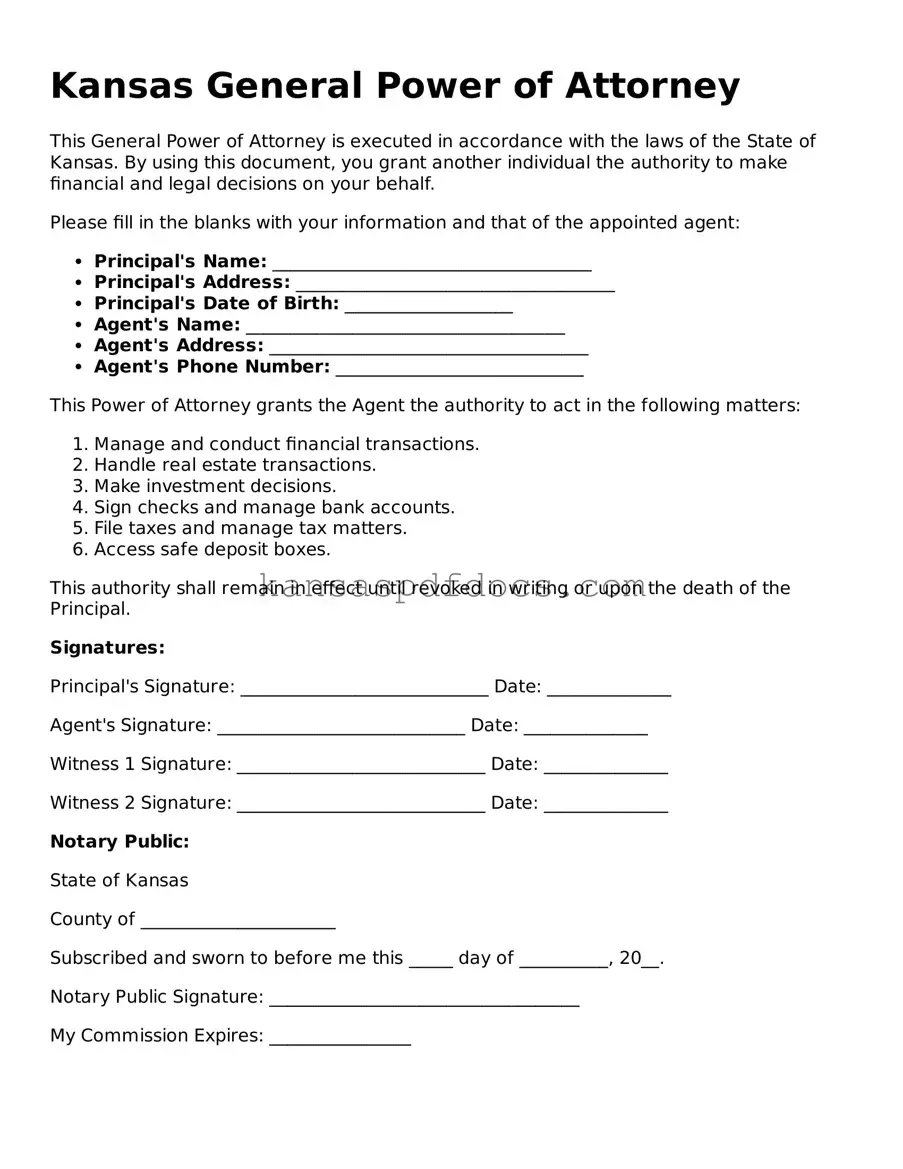

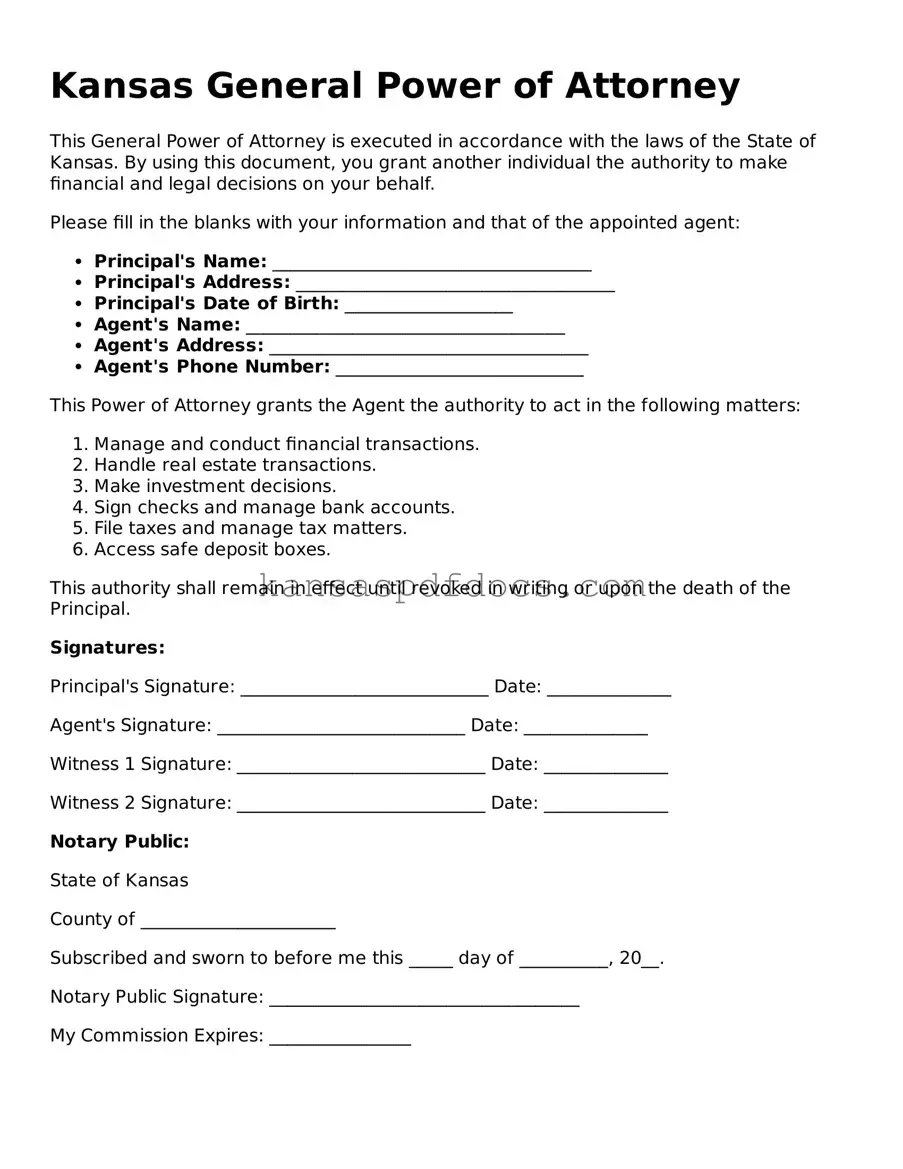

Valid General Power of Attorney Template for Kansas State

A General Power of Attorney form in Kansas allows one person to give another the authority to act on their behalf in a wide range of financial and legal matters. This document is important for anyone who wants to ensure their affairs are managed properly when they cannot do so themselves. Understanding how to use this form can provide peace of mind and clarity in times of need.

Access This Form Now

Valid General Power of Attorney Template for Kansas State

Access This Form Now

Your form isn’t ready yet

Edit and finalize General Power of Attorney online without printing.

Access This Form Now

or

Get PDF Form