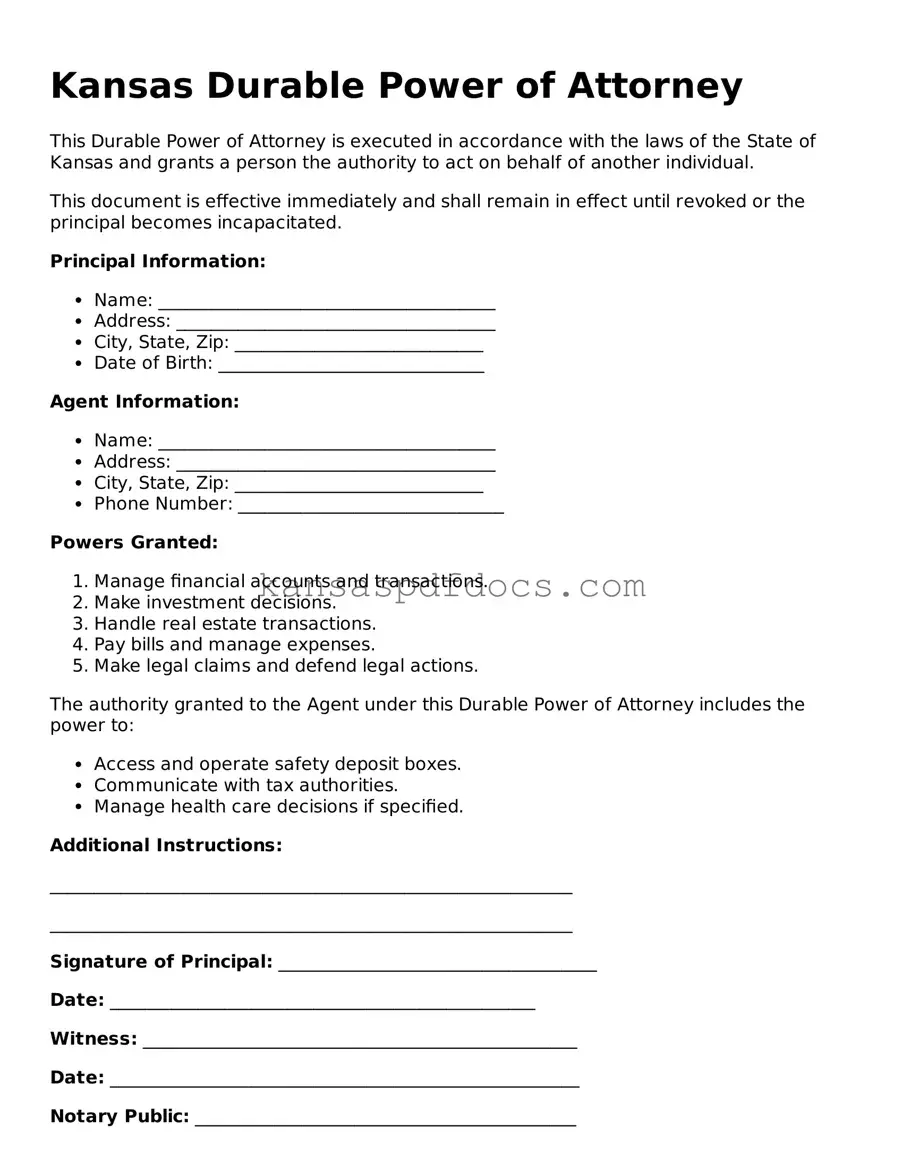

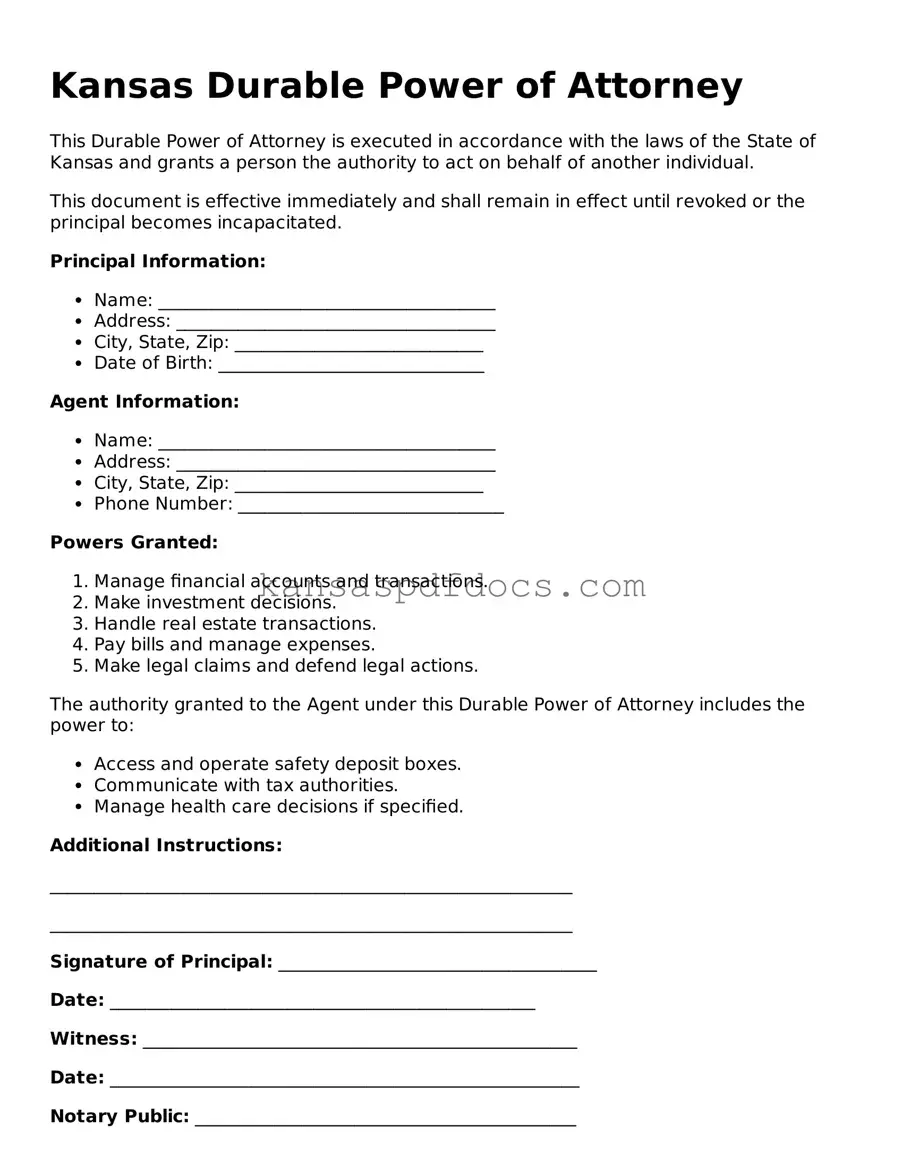

Valid Durable Power of Attorney Template for Kansas State

A Durable Power of Attorney is a legal document that allows an individual, known as the principal, to designate another person, referred to as the agent, to make decisions on their behalf in the event they become incapacitated. In Kansas, this form ensures that the agent can act on behalf of the principal regarding financial and legal matters, even if the principal is unable to do so themselves. Understanding this document is crucial for anyone looking to safeguard their interests and ensure their wishes are honored during difficult times.

Access This Form Now

Valid Durable Power of Attorney Template for Kansas State

Access This Form Now

Your form isn’t ready yet

Edit and finalize Durable Power of Attorney online without printing.

Access This Form Now

or

Get PDF Form