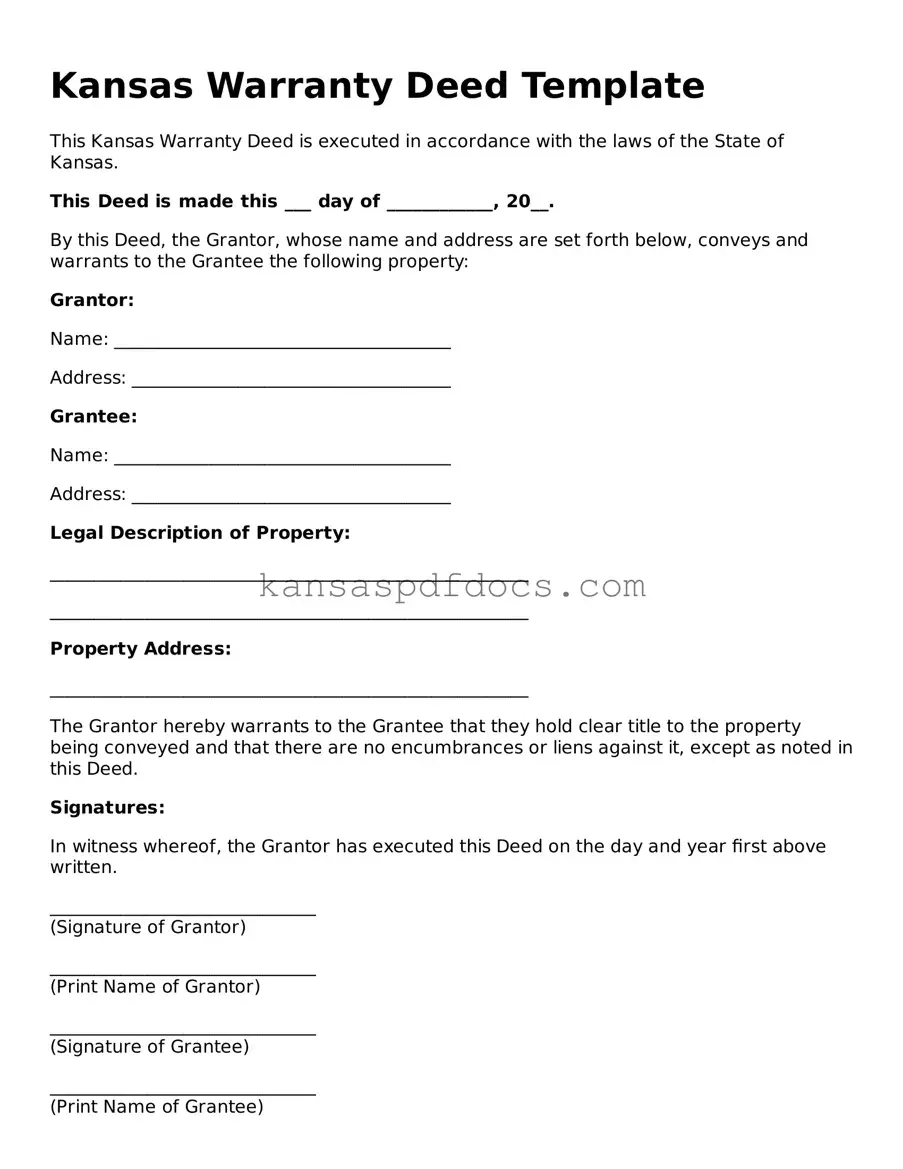

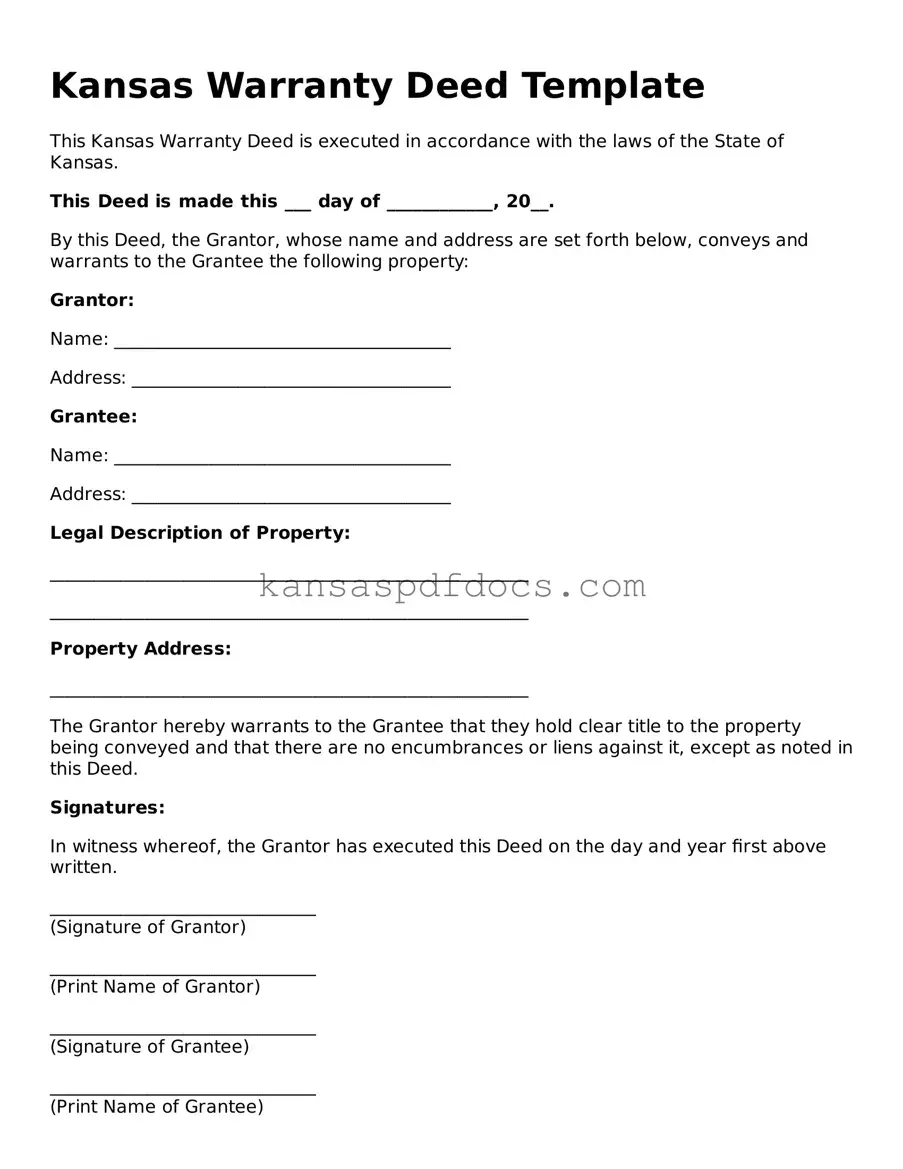

Valid Deed Template for Kansas State

A Kansas Deed form is a legal document used to transfer ownership of real property from one party to another. This form outlines the details of the transaction, including the names of the parties involved and a description of the property. Understanding how to properly complete and file this form is essential for ensuring a smooth property transfer process.

Access This Form Now

Valid Deed Template for Kansas State

Access This Form Now

Your form isn’t ready yet

Edit and finalize Deed online without printing.

Access This Form Now

or

Get PDF Form