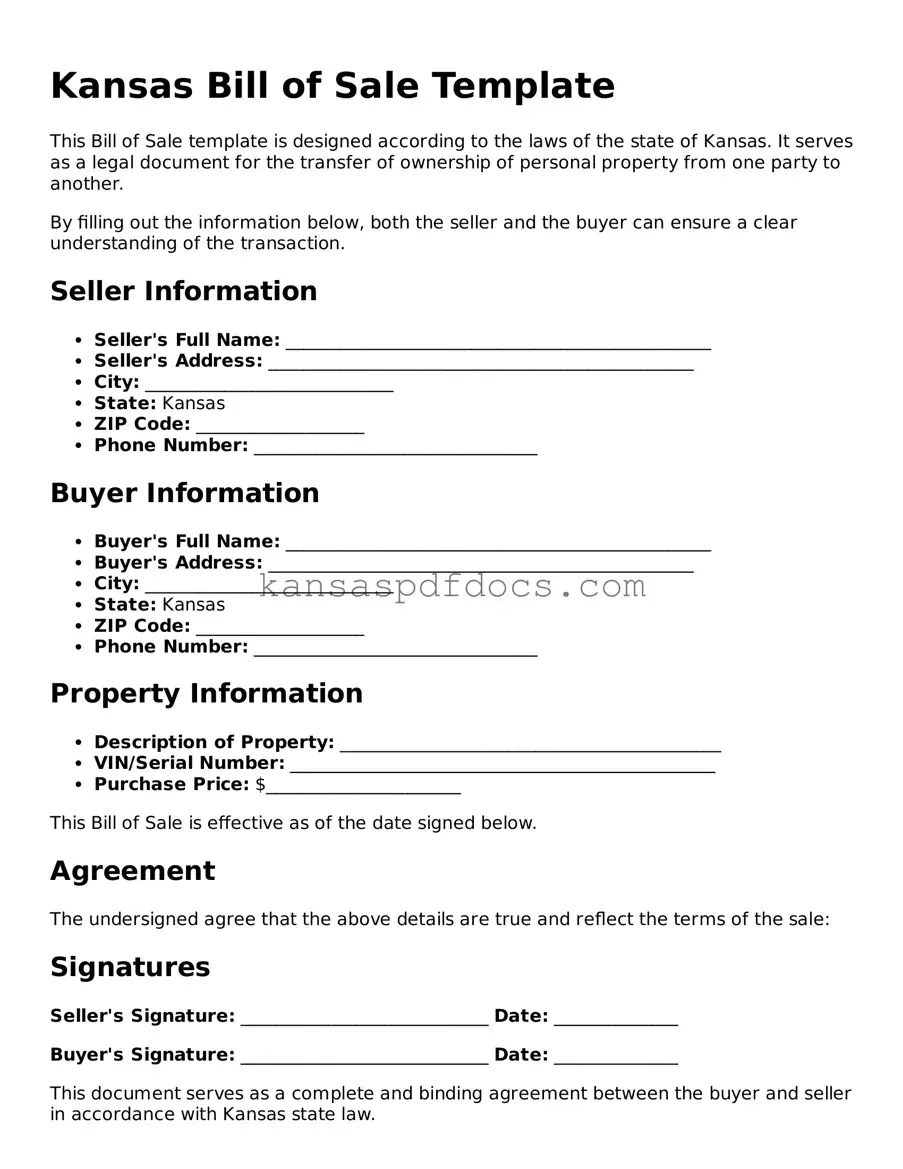

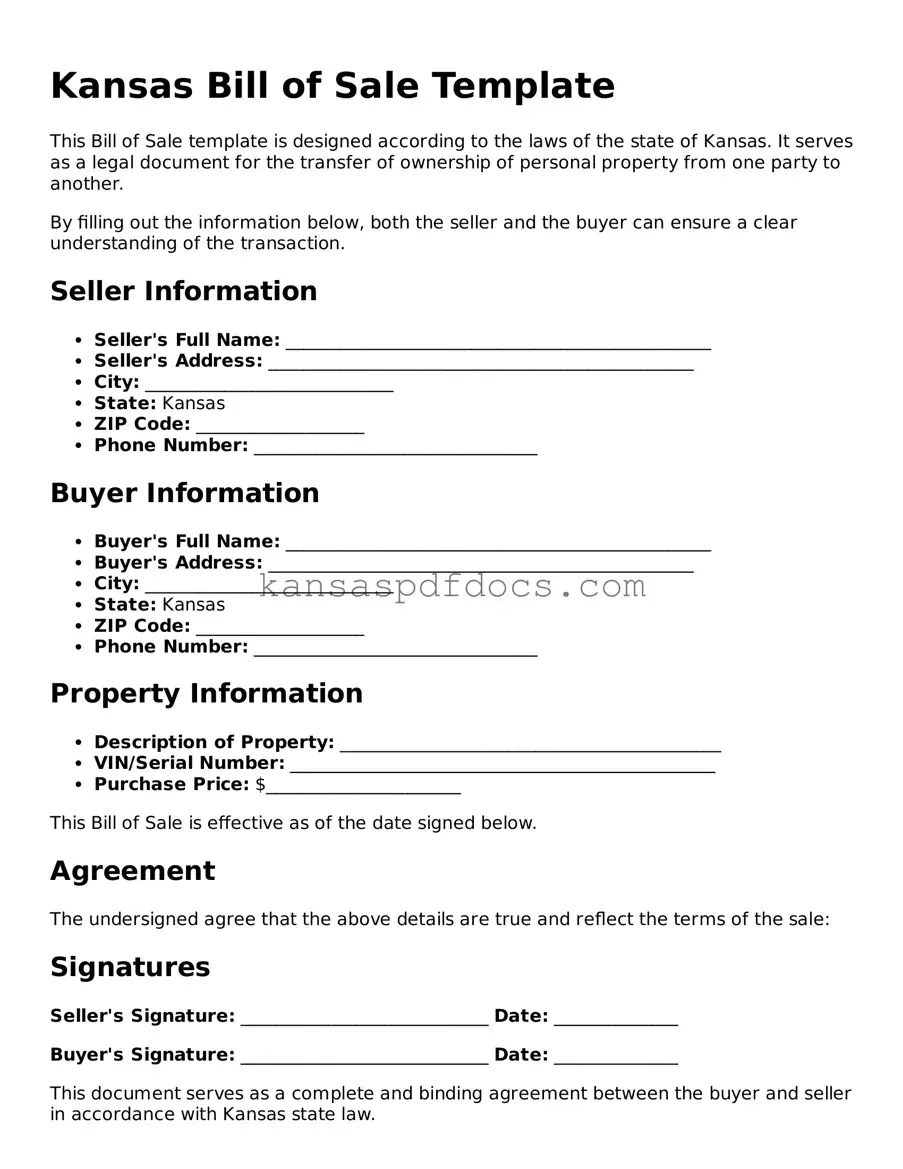

Valid Bill of Sale Template for Kansas State

The Kansas Bill of Sale form serves as a crucial document that records the transfer of ownership of personal property from one individual to another. This form not only protects the interests of both the buyer and the seller but also provides a clear record of the transaction. Understanding its components and significance can help ensure a smooth transfer process.

Access This Form Now

Valid Bill of Sale Template for Kansas State

Access This Form Now

Your form isn’t ready yet

Edit and finalize Bill of Sale online without printing.

Access This Form Now

or

Get PDF Form